FARZAD’S PICKS

UPCOMING EVENTS

Join Farzad and his community for an open discussion about whatever you would like to talk about. All are welcome. Please keep the conversation respectful.

Let’s have some fun.

Join Farzad and his community for an open discussion about whatever you would like to talk about. All are welcome. Please keep the conversation respectful.

Let’s have some fun.

Join Farzad and his community for an open discussion about whatever you would like to talk about. All are welcome. Please keep the conversation respectful.

Let’s have some fun.

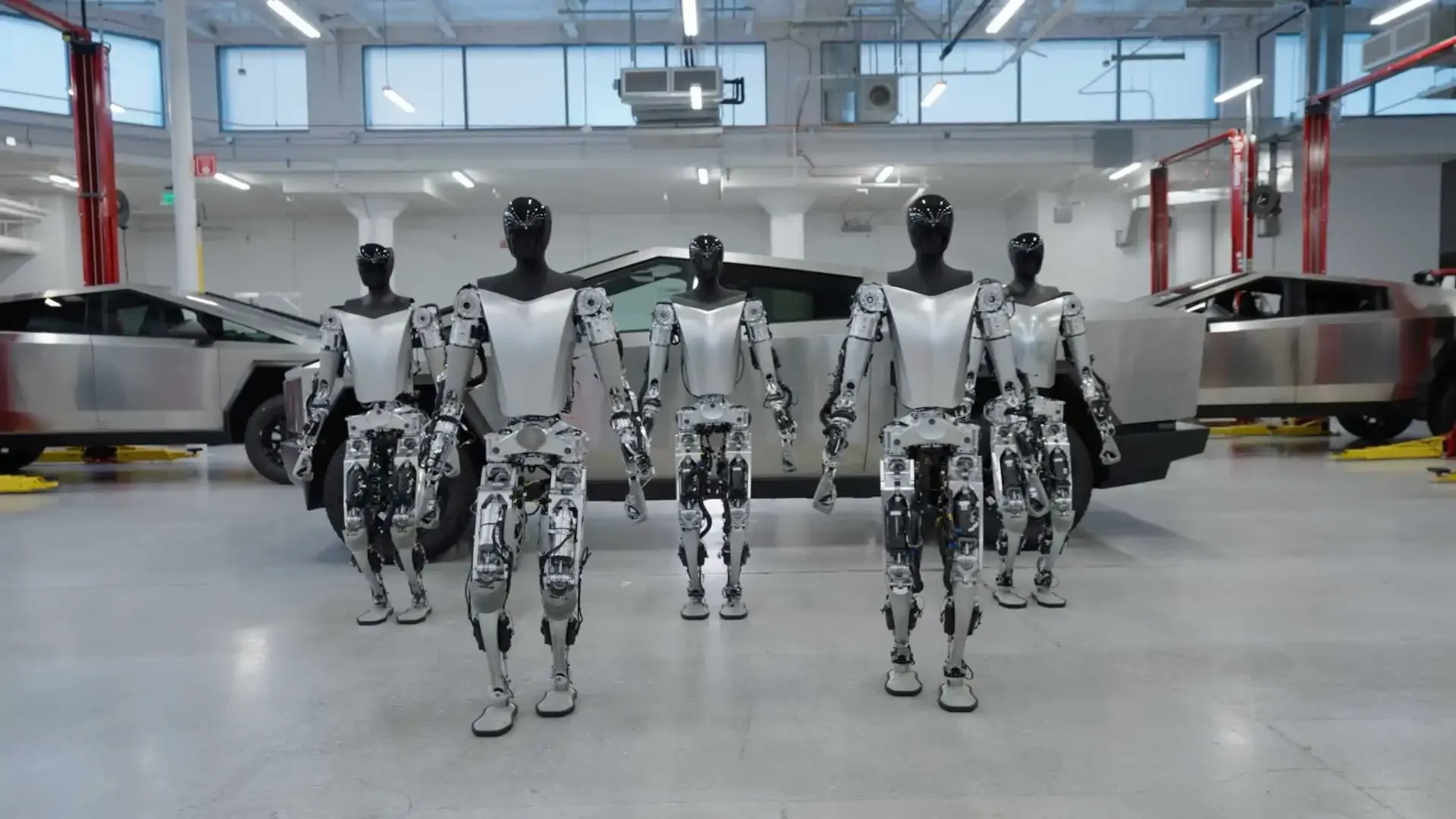

In this episode, Emmet Peppers joins us to explore Tesla's transformation into an AI powerhouse, from sentient cars to humanoid robots reshaping society by 2030. Dive into the investment potential, market disruptions, and ethical challenges of embodied AI.

Tesla stands at the forefront of AI embodiment, turning vehicles into intelligent robots on wheels and paving the way for massive economic shifts through robotaxis and Optimus bots.

Key Takeaways

Tesla's car business acts as a gateway to understanding its broader AI ambitions, including autonomous fleets and humanoid robots.

Robotaxis could generate immediate profits by undercutting ride-sharing costs, potentially forcing competitors like Waymo out of markets.

Optimus robots may reach Mars by 2030 while revolutionizing factories and daily tasks, creating new markets worth trillions.

Wall Street undervalues Tesla's potential, with stock poised for growth as AI milestones unfold.

Societal transitions demand solutions like universal basic income to address job displacement and inequality.

Tesla's evolution goes beyond electric vehicles, positioning it as the key player in AI-driven autonomy. Robotaxis, already testing in cities like Austin, promise low-cost transport under 40 cents per mile, unlocking innovations like mobile services. Meanwhile, Optimus bots aim to handle 80% of physical labor at costs equivalent to $3 per hour, expanding labor markets exponentially. This creates vast opportunities but raises concerns over wealth gaps, requiring policies to ensure broad access. By decade's end, Tesla could dominate new economies, blending transportation, robotics, and sustainability.

Connect with Emmet Peppers on X

MUST WATCH

In this episode, Emmet Peppers joins us to explore Tesla's transformation into an AI powerhouse, from sentient cars to humanoid robots reshaping society by 2030. Dive into the investment potential, market disruptions, and ethical challenges of embodied AI.

Tesla stands at the forefront of AI embodiment, turning vehicles into intelligent robots on wheels and paving the way for massive economic shifts through robotaxis and Optimus bots.

Key Takeaways

Tesla's car business acts as a gateway to understanding its broader AI ambitions, including autonomous fleets and humanoid robots.

Robotaxis could generate immediate profits by undercutting ride-sharing costs, potentially forcing competitors like Waymo out of markets.

Optimus robots may reach Mars by 2030 while revolutionizing factories and daily tasks, creating new markets worth trillions.

Wall Street undervalues Tesla's potential, with stock poised for growth as AI milestones unfold.

Societal transitions demand solutions like universal basic income to address job displacement and inequality.

Tesla's evolution goes beyond electric vehicles, positioning it as the key player in AI-driven autonomy. Robotaxis, already testing in cities like Austin, promise low-cost transport under 40 cents per mile, unlocking innovations like mobile services. Meanwhile, Optimus bots aim to handle 80% of physical labor at costs equivalent to $3 per hour, expanding labor markets exponentially. This creates vast opportunities but raises concerns over wealth gaps, requiring policies to ensure broad access. By decade's end, Tesla could dominate new economies, blending transportation, robotics, and sustainability.

Connect with Emmet Peppers on X

In this episode, we explore AI and robotics' transformative impact on society, from automation to Mars colonization. We discuss how technology drives progress, the challenges of disruption, and a bold vision for a future of abundance, connectivity, and sustainability in the next 20 years.

Dive into a fascinating discussion on how AI, robotics, and innovative technologies are reshaping society and paving the way for a future of abundance. This episode unpacks the potential for automation to eliminate tedious labor, the role of visionary entrepreneurs in driving progress, and the societal shifts needed to navigate the next 20 years. From self-driving cars to Mars colonization, we explore the opportunities and challenges of a rapidly evolving world.

Key Takeaways

Automation Revolution: AI and robotics will eliminate repetitive, dangerous jobs, freeing humans for creative and meaningful pursuits.

Economic Polarization: Winner-takes-all dynamics in AI-driven industries may widen wealth gaps, necessitating solutions like universal basic income (UBI).

Global Connectivity: Technologies like Starlink will connect 3 billion people, unlocking entrepreneurial potential in underserved regions.

Mars as a Catalyst: Innovations for Mars colonization, like electric vehicles and alternative proteins, will drive sustainable industries on Earth.

Entrepreneurial Boom: A new wave of startups, inspired by bold visions, is tackling global challenges like climate change and food production.

This episode delves into the transformative power of AI and robotics, painting a vivid picture of a future where automation handles mundane tasks, leaving humans to focus on creativity, science, and cultural advancement. We explore how technologies like self-driving cars and humanoid robots are already disrupting industries, with companies leveraging data flywheels to outpace competitors. The discussion highlights the potential for a world of abundance, where goods cost as little as a dollar per pound to produce, and global connectivity via satellite networks empowers billions. However, the transition poses challenges, including economic polarization and societal upheaval as industries shift to information-driven models. We also discuss the role of visionary entrepreneurs in inspiring a new generation to tackle ambitious goals, from sustainable energy to Mars colonization, and how these innovations could create new industries on Earth. The episode emphasizes the need for forward-thinking policies to ensure equitable progress and maintain societal stability during this rapid transformation.

Connect with Steve Jurvetson on X.

Cern Basher explores Tesla's leadership in AI and energy, alongside Bitcoin's potential as a secure store of value in a world of currency debasement.

Cern Basher joins us to dive into Tesla's pioneering role in AI, autonomous vehicles, and sustainable energy, while exploring Bitcoin's transformative potential as a store of value. The discussion unpacks how Tesla's vision aligns with a future where digital assets like Bitcoin could redefine wealth preservation amidst global economic shifts.

Key Takeaways

Tesla's leadership drives innovation in AI, autonomous transport, and sustainable energy, positioning it as a tech powerhouse.

Bitcoin is presented as a superior store of value, outpacing traditional assets like gold and fiat currencies over time.

Currency debasement erodes purchasing power, with examples like the US dollar losing 65% of its value in 30 years.

Bitcoin's security protocol, backed by immense computing power, makes it a robust defense against cyber threats.

Historical skepticism toward innovations like Amazon mirrors initial doubts about Bitcoin, yet both have proven resilient.

The episode highlights Tesla's forward-thinking leadership, emphasizing its advancements in AI, autonomous transportation, and sustainable energy as a beacon for tech enthusiasts. The conversation then pivots to a critical examination of money, using the historical example of the Island of Yap’s stone money to illustrate how societies assign value. This sets the stage for discussing modern currency issues, such as inflation and debasement, which diminish purchasing power—evidenced by the US dollar’s 65% value loss over three decades. Bitcoin emerges as a compelling solution, with its finite supply of 21 million coins and decentralized, energy-intensive proof-of-work system ensuring security. The discussion draws parallels with past skepticism toward Amazon, noting how Bitcoin, once dismissed, has grown into a $2.4 trillion asset. The episode also explores Bitcoin’s potential as a cybersecurity protocol, citing Jason Lowry’s thesis that frames it as a “weapon system” for protecting digital assets. As Tesla and other companies consider Bitcoin for treasury reserves, its role in a future of AI-driven abundance and economic disruption becomes clear, offering a hedge against fiat currency’s fragility.

Connect with Cern Basher on X.

In this episode, Larry joins us to explore how Elon Musk acquiring Apple could revolutionize tech. From leveraging vast user data for AI digital twins to integrating Grok and boosting innovation, the discussion reveals untapped potential in Apple's ecosystem amid stagnant growth and China dependency.

Unlocking Apple's hidden value through bold acquisition could reshape AI, devices, and space exploration.

Key Takeaways

Apple's innovation has stalled since Steve Jobs, relying on iPhone updates and facing manufacturing risks in China.

Acquiring control via 10% stake, leveraging alliances with institutions like Vanguard and banks like JP Morgan, is feasible without full buyout.

Core value lies in billions of users' private data, enabling Grok-powered digital twins for personalized AI in devices, robots, and vehicles.

Integration could double Apple's stock value, redirect cash flow from buybacks to fund Mars missions, and automate manufacturing globally.

Overcomes privacy hurdles by keeping data secure, outpacing competitors like OpenAI or Google in trusted AI ecosystems.

Apple's current trajectory shows massive revenue but little forward momentum, with failed projects like Vision Pro and Project Titan highlighting leadership gaps. An acquisition would infuse Elon Musk's vision, transforming iPhones into AI hubs synced with Optimus robots and Tesla vehicles. By automating production and shifting from China dependency, new revenue streams emerge from satellite-enabled devices and embodied AI. This move not only revitalizes Apple's hardware but channels its $110 billion annual cash flow—currently funneled into $77 billion buybacks and $15 billion dividends—toward groundbreaking advancements, potentially doubling cash flow through AI enhancements and eliminating redundant features.

Connect with Larry Goldberg on X.

Tesla's push into embodied AI isn't just incremental innovation—it's the catalyst for entirely new markets worth trillions, from autonomous fleets to robots handling everyday tasks. Dive into how this technology could generate unprecedented wealth while reshaping society, and why owning a piece of it might be the smartest move for the coming decade.