Elon Musk Drops Bombshell: Flying Cars, AI Dominance, and the Death of Apps

Revolutionizing Tech from Wheels to Wings and Beyond

Electric vehicles are evolving into something far more ambitious, with prototypes set to redefine mobility. At the same time, artificial intelligence is poised to eliminate traditional software structures, while massive compute resources could emerge from unexpected places like car fleets. These shifts promise to reshape industries, but they also highlight risks in unchecked tech power and the need for transparent platforms.

Key Takeaways

A new vehicle prototype demo is imminent, featuring technology that could enable flight and surpass anything seen in fiction.

Efforts to balance AI development against dominant players have backfired, leading to closed systems focused purely on revenue.

Vehicle fleets numbering in the hundreds of millions could deliver unprecedented distributed computing power for AI tasks.

Traditional smartphones will give way to AI-driven devices without operating systems or apps, handling all interactions seamlessly.

Most media and entertainment will soon be generated by AI, with coherent long-form videos already emerging.

AI efficiency can improve dramatically by mimicking the human brain's low-power design, unlocking new capabilities.

Acquiring social platforms has become essential to counter information suppression and preserve open discourse.

Democrats Mend Fences with Elon Musk: A Turning Point for Tech Innovation

Why political reconciliation could unlock faster progress in EVs, autonomy, and space exploration

Recent admissions from Democratic leaders highlight a key oversight in past electric vehicle policies, opening doors to broader collaboration with innovators like Elon Musk. This shift signals potential bipartisan backing for ambitious projects in autonomous transport and space tech, which could reshape industries and reduce regulatory hurdles ahead.

Key Takeaways

Democrats are publicly recognizing errors in sidelining Elon Musk during early EV initiatives, aiming to rebuild ties for future influence.

SpaceX stands as a critical national asset for U.S. defense and space dominance, making partnership essential regardless of political divides.

Tesla's push into fully autonomous vehicles like the Cybercab promises massive cost reductions in transportation but poses significant disruptions to legacy auto makers and ride-sharing services.

Regulatory de-risking from both parties could accelerate innovations in rocketry, brain-computer interfaces, and humanoid robots over the next decade.

The economic ripple effects include lower transport costs by up to 10x, but require careful planning to mitigate job displacements for millions of drivers.

Why Tesla Might Build a Cybercab with a Steering Wheel After All

Unveiling the hidden logic behind Tesla's robotaxi ambitions—and how a hybrid approach could supercharge global adoption.

Tesla's push into fully autonomous vehicles like the Cybercab promises to reshape transportation, but the road ahead involves navigating production efficiencies, regulatory mazes, and fierce market dynamics. At its core, this shift could unlock ultra-low-cost rides, disrupt giants like Uber, and open doors in emerging economies—all while hedging against uncertainties that might otherwise idle billion-dollar factories.

Key Takeaways

Tesla's new unboxed manufacturing process could enable production of up to 2 million Cybercab-like vehicles annually by late 2027 or 2028, far outpacing current lines due to parallel assembly techniques.

Current U.S. regulations cap driverless vehicles without steering wheels or pedals at 2,500 units per year, creating a massive bottleneck for mass production unless federal changes arrive swiftly.

Achieving full autonomy requires not just technological readiness but regulatory approval, including data on millions of miles driven, and a potential national framework to standardize rules across states.

A Cybercab variant with manual controls could fill production gaps, tap into global demand for affordable EVs in markets like Europe, China, and India, and leverage existing Tesla fleets for on-demand robotaxi surges.

Operating costs for autonomous rides could drop to around 30 cents per mile, undercutting Uber's model and offering consistent, private experiences at half the price or less.

International risks, including data privacy concerns and geopolitical tensions, make a steerable version essential for scaling beyond the U.S. without waiting for worldwide approvals.

The Visionary Powerhouse Reshaping America’s Future

How One Innovator’s Drive Fuels National Security and Global Progress

The United States stands at a pivotal moment in technological and industrial advancement, driven by a singular force whose impact spans electric vehicles, space exploration, and global connectivity. This individual’s ability to challenge conventional approaches, prioritize purpose over profit, and execute on an unparalleled scale has redefined what’s possible for American innovation. From revolutionizing transportation to securing national interests through space and communication technologies, the ripple effects of this work are profound and far-reaching.

Key Takeaways

Catalyst for Innovation: Without this visionary, critical advancements in electric vehicles, space exploration, and artificial intelligence might have been delayed by decades, stalling U.S. progress.

National Security Asset: The development of American-made rockets and global communication networks strengthens the country’s strategic position.

First Principles Thinking: By rejecting traditional research methods and focusing on fundamental truths, this leader has disrupted stagnant industries.

Purpose-Driven Leadership: A relentless focus on existential goals, like making humanity multi-planetary, drives unmatched productivity and impact.

Accessibility and Transparency: Unlike many global leaders, this figure engages directly with the public, fostering trust and inspiring entrepreneurs.

Tesla’s Bold Pivot: Affordable EVs and the All-In Bet on Autonomy

Why Tesla’s Latest Moves Signal a Radical Shift Toward Self-Driving Innovation

Tesla’s recent announcement of more affordable Model 3 and Model Y vehicles has sparked heated discussion among tech enthusiasts and investors alike. While these price cuts aim to make electric vehicles (EVs) more accessible, they also reveal a deeper strategy: Tesla is betting big on autonomous driving to redefine the automotive industry. By prioritizing software-driven, fully self-driving vehicles like the Cybercab, Tesla is moving away from traditional car manufacturing and toward a future where steering wheels and pedals may become obsolete. This newsletter unpacks the implications of Tesla’s strategy, its challenges, and why 2026 could be a pivotal year for the company.

Key Takeaways

Affordable Models Fall Short of Expectations: The new Model 3 and Model Y are priced competitively, but the loss of the $7,500 EV tax credit in the U.S. offsets much of the cost advantage, leaving them only marginally cheaper than before.

Tesla’s Growth Is Stalled Without Autonomy: With a production capacity of 3 million units annually, Tesla’s current lineup (Model 3, Y, S, X, Cybertruck) is unlikely to exceed 2.2 million units per year, far from the company’s ambitious goals.

Full Self-Driving (FSD) Is the Core Strategy: Tesla is banking on its advanced FSD software, particularly version 14, to drive demand by offering unmatched convenience and safety, making its vehicles a compelling alternative to traditional cars.

Cybercab Signals a Driverless Future: Tesla’s autonomous Cybercab, a two-seater with no steering wheel or pedals, is designed to dominate ride-sharing with a cost per mile as low as $0.40, potentially disrupting services like Uber.

Regulatory Hurdles Loom Large: Tesla’s autonomous ambitions hinge on faster-than-expected regulatory approvals, with only Texas and Arizona currently allowing driverless operations at scale.

Holistic Ownership Model: Tesla is integrating financing, insurance, maintenance, and charging into a single monthly payment, aiming to simplify and lower the cost of ownership to boost sales.

Tesla's Tease Machine: From Wobbly Wheels to Kung Fu Bots

Unveiling the Next Wave of Innovation That's Priming Investors for a $8.5 Trillion Payday

Tesla's latest product hints point to a surge in affordable EVs, high-performance gadgets, and home energy efficiencies that could slash utility bills while boosting stock value. Investors are buzzing as these reveals align with a pivotal vote on executive compensation, signaling a return to the company's disruptive roots.

Key Takeaways

Tesla is gearing up for a sub-$35,000 EV launch, potentially featuring unique wheel designs that hint at advanced stability tech for everyday drives.

The next-gen Roadster may incorporate road-suction mechanisms for extreme downforce, elevating it beyond typical supercars into track-dominating territory.

Home energy solutions like solar-plus-battery leases promise long-term savings over grid power, especially in high-cost or remote areas, with buyout options after five years.

Optimus robots are advancing through video-based AI learning, enabling fluid movements like martial arts sequences without manual coding.

A mysterious rotating device teaser, set for reveal on October 7, could span drones, HVAC units, or even Cybertruck-inspired vans, broadening Tesla's ecosystem.

Amid these unveils, November 8 brings a shareholder vote on a compensation package tied to an $8.5 trillion market cap milestone, rewarding early backers with massive gains.

Tesla's Budget EV Breakthrough: The Affordable Model Y Uncovered

Revamping Accessibility in Electric Vehicles Amid Shifting Incentives

Spy shots from Texas highways and firmware leaks have pulled back the curtain on Tesla's push for a more budget-friendly Model Y variant. This stripped-down crossover targets everyday drivers by trimming premium features while keeping the essentials intact, all to maintain production momentum and gather vast amounts of driving data for advancing full self-driving tech.

Key Takeaways

Tesla's affordable Model Y features simplified exterior elements like no front or rear light bars, a front bumper camera, and smaller 18-inch wheels for better efficiency.

Interior cuts include no glass roof, no rear screen, cloth or basic vegan leather seats without ventilation, and a basic audio system to reduce manufacturing costs.

Expected pricing lands between $35,000 and $40,000, making it competitive without relying on expired US EV tax credits.

Production ramps up in the second half of 2025, with rear-wheel-drive as the base option and potential all-wheel-drive upgrades.

This model supports Tesla's strategy to flood roads with vehicles, accelerating data collection for autonomous systems and software revenue.

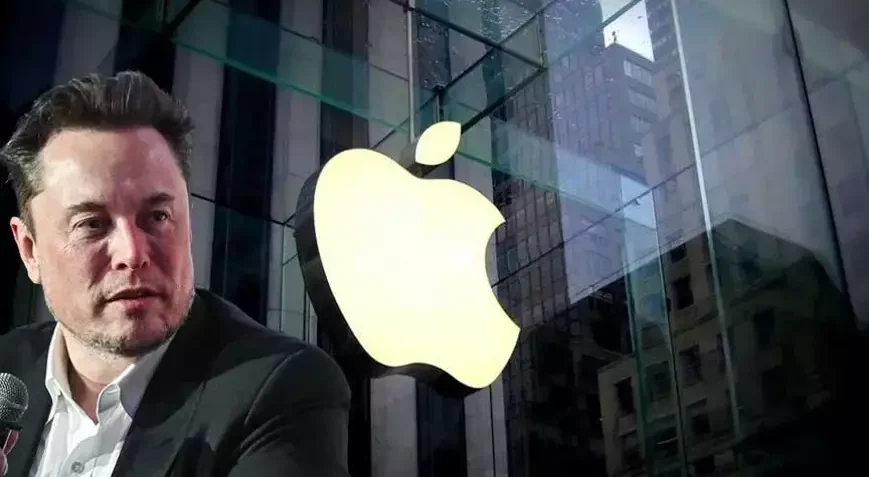

Elon Musk's Next Big Move: Acquiring Apple to Ignite the AI Revolution

Revolutionizing Personal Tech with Secure Data, Robotics, and Space Ambitions

Imagine transforming a trillion-dollar tech giant from a comfortable cash machine into a powerhouse of AI innovation. Acquiring Apple could give Elon Musk access to billions of users' private data to build personalized digital twins, automate global manufacturing, and generate massive cash flows to fuel projects like autonomous vehicles and Mars exploration—all while doubling the company's value through bold reinvention.

Key Takeaways

Apple's innovation has stalled, with products like Vision Pro underperforming and reliance on incremental iPhone updates leading to stagnant growth.

The company's true asset is its ecosystem of over a billion users' private data, which could enable secure AI-powered digital twins for personalized experiences across devices.

Musk could gain control with a 10% stake, valued around $350 billion, by leveraging his companies' combined worth, investor alliances, and banking relationships.

Shifting manufacturing from China through automation would reduce dependencies, while integrating Musk's AI like Grok could supercharge Apple's hardware.

Redirecting Apple's $110 billion annual cash flow from buybacks and dividends to R&D could double revenues, fund ambitious ventures, and attract growth-oriented investors.

Tesla’s Model Y L and the Self-Driving Revolution: Why Autonomy Could Redefine Transportation

Elon Musk’s bold vision for Tesla’s autonomous future raises questions about the Model Y L’s U.S. launch and the transformative potential of Version 14 self-driving technology.

Tesla’s latest moves in the electric vehicle and autonomous driving space are sparking intense discussion among tech enthusiasts. The introduction of the Model Y L in China and advancements in Tesla’s self-driving technology, particularly Version 14, signal a potential shift in how we think about transportation. With Elon Musk hinting that the Model Y L may not come to the U.S. due to the state of autonomy, and posts on X buzzing about the next generation of self-driving software, there’s a lot to unpack. Here’s why these developments could reshape the automotive industry and what they mean for the future of mobility.

Key Takeaways

Model Y L Debuts in China: A stretched version of the bestselling Model Y, featuring a proper third row and captain’s chairs, is set to launch in China at a price equivalent to $47,000, but its U.S. arrival is uncertain due to Tesla’s focus on autonomy.

Autonomy Over New Models: Tesla may prioritize self-driving technology over introducing the Model Y L in the U.S., betting that unsupervised Full Self-Driving (FSD) will drive demand for existing models like the Model Y and Model 3.

Version 14 Breakthrough: The upcoming Version 14 of Tesla’s self-driving software is touted as a significant leap, potentially rivaling the jump from Version 11 to 12, bringing unsupervised autonomy closer to reality.

Robotaxi Momentum: Tesla’s robotaxi service, currently operating with Model Ys in Austin, is a testing ground for unsupervised FSD, with Version 14 expected to enhance reliability and safety.

Disrupting Transportation: If Tesla achieves reliable unsupervised autonomy, it could render traditional vehicles obsolete, transforming cars into productivity hubs and boosting their value as income-generating assets.

Tesla Accelerates: CEO Rewards and Robo-Taxi Expansion Signal a New Era in Autonomy

Unlocking Leadership and Low-Cost Rides in the AI-Driven Future

Tesla has taken decisive steps to secure its leadership in electric vehicles, AI, and robotics by approving an interim compensation package for its CEO while rapidly expanding its robo-taxi network in Austin, Texas. These moves address ongoing legal battles over past awards and position the company to capitalize on surging demand for autonomous services, potentially transforming urban mobility and shareholder value.

Key Takeaways

Tesla's board approved 96 million restricted stock shares as an interim award, increasing CEO ownership to about 14.6% and aligning incentives amid AI talent competition.

The award includes a two-year vesting period, a $23 per share purchase price, and restrictions on sales to minimize market impact.

If the 2018 performance award is reinstated by courts, this interim package will be adjusted to avoid overlap.

Robo-taxi rides in Austin are priced at roughly half of Uber's rates, with a 50-minute trip costing around $18 compared to $31–$34 on Uber.

The Austin geo-fence for robo-taxi operations has doubled in size twice in the past six weeks, now covering expanded areas without major incidents reported.

New Texas regulations effective September 1, 2025, could enable unsupervised robo-taxi operations, paving the way for profitability through low operational costs.

An upcoming shareholder meeting on November 6, 2025, will vote on a long-term CEO compensation strategy and potential investment in xAI, enhancing synergies in AI development.

Retaining top talent, including leadership, is critical as Tesla shifts toward AI, robotics, and services, with the award designed to boost focus and voting control.

Tesla’s Supply Chain Power Play: Securing the Future of AI and Robotics

Why Tesla’s $16.5B Samsung deal and strategic partnerships signal a new era for AI-driven manufacturing

Tesla’s recent moves in the supply chain arena are nothing short of seismic. A $16.5 billion deal with Samsung for advanced AI chips and a $4 billion partnership with LG Chem for battery production are not just business transactions—they’re bold steps toward dominating the future of AI, robotics, and electric vehicles. These deals highlight Tesla’s unmatched ability to secure critical resources, localize manufacturing, and create a supply chain that’s fast, efficient, and resilient. For tech enthusiasts, this is a masterclass in how to build a technological empire in a world of geopolitical tension and supply chain uncertainty.

Key Takeaways

Strategic Partnerships Secure AI Leadership: Tesla’s $16.5B deal with Samsung prioritizes access to a dedicated chip fabrication facility, ensuring a steady supply of AI chips for vehicles, robotaxis, and humanoid robots.

Battery Supply Scaled for Growth: The $4B LG Chem deal bolsters Tesla’s battery production capacity, critical for meeting the soaring demand for electric vehicles, Megapacks, and future robotics.

Localized Manufacturing Reduces Risk: By prioritizing U.S.-based production, Tesla mitigates geopolitical risks tied to global supply chains, particularly in regions like Taiwan.

Supply Chain Flywheel Drives Efficiency: Tesla’s ability to turn inventory quickly and provide demand certainty creates a win-win for suppliers, fostering stronger partnerships and better terms.

AI and Robotics Poised for Dominance: Tesla’s integrated approach to hardware and software, combined with its supply chain prowess, positions it to lead in emerging fields like robotaxis, humanoid robots, and potentially drones.

Key Takeaways from Tesla's Q2 2025 Earnings Call: AI Dominance and the Road Ahead

Tesla's latest earnings reveal a bold pivot to AI-driven growth, with humanoid robots and autonomous tech set to unlock trillion-dollar markets amid short-term financial hurdles.

Tesla's Q2 2025 results underscore a strategic shift toward artificial intelligence and autonomy, positioning the company to lead in transformative sectors like robotics and self-driving vehicles. While near-term earnings face pressure, the focus on scalable AI solutions promises massive long-term value, drawing from expertise in manufacturing, energy, and real-world data.

Key Takeaways

Earnings are expected to stay below prior peaks for at least the next year, potentially leading to flat or declining stock performance unless market multiples rise.

The company is fully committed to AI and autonomy, with all initiatives aligned around advancing robotaxis, humanoid robots, and energy storage.

Leadership expresses strong confidence in dominating future markets through these technologies, backed by plans to use debt if needed to fund capital expenditures.

Market valuation treats Tesla as an AI powerhouse, far exceeding projections from vehicle sales or energy growth alone, with investors eyeing robotaxi rollout speed and profitability.

Humanoid robots could prove viable through cost reductions in factories or sales for urban services, tapping into high-labor-cost industries.

Unsupervised full self-driving capabilities represent the critical threshold for mass adoption, far outpacing current supervised systems in appeal.

Batteries remain essential for balancing energy supply and demand fluctuations, ensuring ongoing demand as global consumption grows.

Progress in AI aspirations can sustain high valuations, enabling self-funding, but any setbacks in robotaxis or bots could trigger sharp declines.

Tesla's Model Y L Ushers in a New Era of Affordable Family EVs and Autonomous Rides

Expanding Tesla's lineup with a stretched, six-seater crossover that bridges gaps in the market while amplifying robo-taxi potential.

Tesla just dropped details on its latest vehicle, the Model Y L, a longer-wheelbase version designed for families needing more space without breaking the bank. This move not only plugs a hole in the affordable three-row EV segment but also ties into broader shifts like robo-taxi fleets and AI integrations that could redefine personal transport. For tech fans eyeing sustainable mobility, this signals Tesla ramping up production efficiency and versatility in a competitive landscape.

Key Takeaways

The Model Y L extends the standard model by 7 inches, adding a usable third row for six passengers, starting around $60,000 in China with potential U.S. pricing between the Model Y and Model X.

It positions Tesla stronger against rivals like the Kia EV9 and Rivian R1S by offering a more affordable three-row EV option.

Robo-taxi services in Austin are expanding, with seamless autonomous rides becoming practical for daily use, costing under $15 round-trip for urban commutes.

This vehicle enhances Tesla's robo-taxi strategy, enabling higher-capacity rides beyond the upcoming two-seater Cybercab, potentially scaling to millions of units annually.

Speculation points to phasing out older models like the S and X to free up factory space for high-volume production or new ventures like drones or AI devices.

Grok AI is rolling out as a car assistant, paving the way for voice-activated features and cross-device integration, potentially challenging smartphone ecosystems.

Overall, these developments aim at sustainable abundance, prioritizing mass-market EVs and AI-driven autonomy over luxury niches.

Tesla's Wild Ride

Musk vs. Trump Round Two Rocks Markets

The EV giant's stock tumbles 7% as its CEO launches a new political movement while sparring with the president over subsidies and spending

The tech world woke up to fireworks this Tuesday as two of America's most prominent figures locked horns over government spending, subsidies, and the future of American politics. What started as a disagreement over legislation has spiraled into a full-blown feud with major implications for Tesla investors and the broader tech ecosystem.

Key Takeaways

Tesla stock plunged 7% at market open amid investor concerns over Musk's latest political ventures

Musk announced formation of the "American Party" aimed at primarying Republicans who support the current spending bill

Trump suggested investigating deportation of Musk and redirecting DOGE efforts to examine his government subsidies

The dispute centers on a major spending bill that would extend Trump-era tax cuts while potentially eliminating EV tax credits

Congressional approval ratings sit at 23%, creating an opening for political disruption

Tesla faces headwinds from soft global auto sales, reduced cash flow, and dependency on unproven robotaxi technology

Polls show even Musk supporters prefer him to stay out of direct political leadership roles.

SpaceX's Path to $12.8 Trillion

Why the Space Economy's Future is Bigger Than You Think

What if Mars isn’t just a science project—but an actual line item on a trillion-dollar balance sheet?

A groundbreaking new valuation model from ARK Invest and Mach 33 suggests that SpaceX could become the most valuable company in history, with base-case projections reaching $2.5 trillion by 2030 and $12.8 trillion by 2040. And that’s just the middle scenario.

The model goes beyond speculative hype. Built using Monte Carlo simulations and more than 50 variables, it charts a future where Starlink generates massive global cash flows through 2035—then shifts entirely to funding Mars development. At the heart of the plan? Not astronauts. Not colonies. But a million Optimus robots working on Mars by 2040.

Starlink becomes the cash engine. Starship becomes the logistics network. Optimus becomes the labor force. And Mars becomes the next economic frontier—not through abstract sci-fi dreams, but infrastructure, book value, and scalable industrial development.

Inside this analysis:

Why Starlink’s economics are better than most investors realize

How Wright’s Law is driving down satellite costs faster than Moore’s Law

Why competition like Amazon Kuiper may never catch up

What 100+ Starship launches per year really signals

How SpaceX plans to shift from internet provider to interplanetary builder

Why the first Martians will be robots—and why that changes everything

And what the model doesn’t include that could push valuations even higher

This isn’t just about satellites or space travel. It’s the dawn of a new industrial age—off Earth.