Why Elon Musk Should Buy Apple

Unlocking Apple's hidden value through bold acquisition could reshape AI, devices, and space exploration.

Key Takeaways

Apple's innovation has stalled since Steve Jobs, relying on iPhone updates and facing manufacturing risks in China.

Acquiring control via 10% stake, leveraging alliances with institutions like Vanguard and banks like JP Morgan, is feasible without full buyout.

Core value lies in billions of users' private data, enabling Grok-powered digital twins for personalized AI in devices, robots, and vehicles.

Integration could double Apple's stock value, redirect cash flow from buybacks to fund Mars missions, and automate manufacturing globally.

Overcomes privacy hurdles by keeping data secure, outpacing competitors like OpenAI or Google in trusted AI ecosystems.

Apple's current trajectory shows massive revenue but little forward momentum, with failed projects like Vision Pro and Project Titan highlighting leadership gaps. An acquisition would infuse Elon Musk's vision, transforming iPhones into AI hubs synced with Optimus robots and Tesla vehicles. By automating production and shifting from China dependency, new revenue streams emerge from satellite-enabled devices and embodied AI. This move not only revitalizes Apple's hardware but channels its $110 billion annual cash flow—currently funneled into $77 billion buybacks and $15 billion dividends—toward groundbreaking advancements, potentially doubling cash flow through AI enhancements and eliminating redundant features.

AI, Robotics, and the Future: A Vision for Society in 20 Years

Dive into a fascinating discussion on how AI, robotics, and innovative technologies are reshaping society and paving the way for a future of abundance. This episode unpacks the potential for automation to eliminate tedious labor, the role of visionary entrepreneurs in driving progress, and the societal shifts needed to navigate the next 20 years. From self-driving cars to Mars colonization, we explore the opportunities and challenges of a rapidly evolving world.

Key Takeaways

Automation Revolution: AI and robotics will eliminate repetitive, dangerous jobs, freeing humans for creative and meaningful pursuits.

Economic Polarization: Winner-takes-all dynamics in AI-driven industries may widen wealth gaps, necessitating solutions like universal basic income (UBI).

Global Connectivity: Technologies like Starlink will connect 3 billion people, unlocking entrepreneurial potential in underserved regions.

Mars as a Catalyst: Innovations for Mars colonization, like electric vehicles and alternative proteins, will drive sustainable industries on Earth.

Entrepreneurial Boom: A new wave of startups, inspired by bold visions, is tackling global challenges like climate change and food production.

This episode delves into the transformative power of AI and robotics, painting a vivid picture of a future where automation handles mundane tasks, leaving humans to focus on creativity, science, and cultural advancement. We explore how technologies like self-driving cars and humanoid robots are already disrupting industries, with companies leveraging data flywheels to outpace competitors. The discussion highlights the potential for a world of abundance, where goods cost as little as a dollar per pound to produce, and global connectivity via satellite networks empowers billions. However, the transition poses challenges, including economic polarization and societal upheaval as industries shift to information-driven models. We also discuss the role of visionary entrepreneurs in inspiring a new generation to tackle ambitious goals, from sustainable energy to Mars colonization, and how these innovations could create new industries on Earth. The episode emphasizes the need for forward-thinking policies to ensure equitable progress and maintain societal stability during this rapid transformation.

Tesla's Mega Block: AI Energy Revolution

Discover how Tesla's energy innovations are poised to transform AI infrastructure, from enhanced storage to decentralized power solutions.

Key Takeaways

Tesla's Mega Block increases energy density by 20-25%, enabling more efficient scaling for massive AI compute demands.

Simplified assembly reduces cabling and onsite work, cutting costs and speeding deployment.

Data centers face extreme load swings, making onsite storage essential to buffer grid stress.

Efficiency gains in chips may boost demand rather than reduce it, following Jevons paradox.

Future shifts toward DC-powered, off-grid setups could bypass transformers, expanding renewables' viability.

Longer-duration storage like eight-hour capabilities opens new markets for grid buffering and intermittency management.

Tesla's integration of transformers and potential in-house production aims to eliminate multi-year bottlenecks.

Tesla's energy sector is ramping up rapidly, targeting a 200 gigawatt-hour run rate by mid-2027, potentially generating $50 billion in revenue at solid margins. The Mega Block evolves existing tech by packing larger cells and streamlining connections, ensuring transportability while maximizing output. As AI training and inference explode, centralized data centers will demand gigawatt-scale buffering to handle volatile loads without grid disruption. Inference compute may dominate long-term, pushing edge devices like robots, but regional facilities will still require robust storage. Off-grid trends, blending solar, gas, and batteries, promise efficiency by eliminating AC-DC conversions. Overall, these advancements position energy as a core Tesla growth driver, complementing AI and autonomy.

Understanding Ricardian and Alexander Gains in Global Trade

Dive into the core of international trade with an engaging exploration of two fundamental concepts: Ricardian and Alexander gains from trade. This episode unpacks how countries benefit from specializing in what they produce most efficiently and transferring capital to maximize global productivity, offering tech enthusiasts a clear lens on trade’s economic impact.

Key Takeaways

Ricardian Gains: Countries gain by specializing in goods where they have a comparative advantage, driven by differences in labor productivity.

Alexander Gains: Capital flows from high-saving, low-investment countries to those with high investment opportunities, boosting global efficiency.

Trade Deficits and Surpluses: Trade imbalances reflect capital movement, with deficits signaling capital imports and surpluses indicating exports.

Protectionism Risks: Tariffs, like the Smoot-Hawley Tariff, can disrupt trade benefits, historically leading to economic downturns.

Modern Trade Dynamics: Flexible executive actions and reciprocity challenges shape today’s trade policies, impacting global economies unevenly.

This episode breaks down the Ricardian model, which highlights how countries benefit from trade by focusing on goods they produce most efficiently due to labor productivity differences. Using the classic example of wine and cloth, we see how comparative advantage allows even less productive nations to gain from trade by specializing. The discussion then shifts to Alexander gains, where capital moves from countries with excess savings to those with high investment potential, illustrated by a machine’s journey from Japan to the U.S., enhancing productivity and creating trade surpluses and deficits. Historical examples, like the U.S.’s trade deficits from 1640 to 1870, show how capital imports fueled growth. However, protectionist policies, such as the Smoot-Hawley Tariff, demonstrate the risks of disrupting these gains, potentially triggering economic crises. Modern trade is more flexible, with executive orders enabling rapid policy shifts, but reciprocity issues highlight the U.S.’s role as a free-trade leader facing protectionist barriers abroad. The episode also touches on how large economies like the U.S. face less severe losses in trade wars compared to smaller nations, emphasizing the uneven impact of trade disruptions.

Tesla Model 3: 180,000 Miles of Reliability

In this episode, a 2018 Tesla Model 3 with nearly 180,000 miles is put under the spotlight, showcasing its enduring reliability and performance for a daily 160-mile commute in Bethlehem, Pennsylvania. The owner, a dedicated commuter, shares insights on why this EV remains a standout choice for tech enthusiasts, highlighting its handling, cost efficiency, and minimal maintenance needs.

Key Takeaways

High Mileage, High Reliability: The Model 3, with 179,316 miles, runs smoothly with minimal issues, needing only a control arm replacement and a self-repaired side mirror.

Impressive Handling: The car’s steering and road grip remain solid, offering a fun, responsive drive comparable to manual cars.

Winter Range Impact: Cold weather reduces range by about 25%, from 240 miles to ~180 miles, but strategic charging prevents issues.

Cost Savings: The Tesla app highlights significant gas savings, making it economical for long commutes.

EV-Specific Tires: Specialized tires reduce road noise by ~30%, improving comfort.

The episode dives into the owner’s experience with a 2018 Tesla Model 3 Long Range Rear-Wheel Drive, used for a demanding 80-mile-each-way commute. Despite its high mileage, the car’s handling remains exceptional, with no rattles or loss of performance. The owner praises its reliability, having only replaced a front control arm and a $100 side mirror, which they fixed themselves using YouTube guides. Winter range loss is manageable, with nightly charging at 80-85% ensuring no range anxiety, thanks to nearby Tesla chargers. The car’s acceleration and handling make it a joy to drive, though the owner prefers manual control over Full Self-Driving (FSD) due to their love for driving. Minor drawbacks include a plain interior, lack of a spare tire, and temperature challenges from the glass roof, which a new shield helps mitigate. The owner recommends Tesla over other EVs, citing its superior reliability and performance, and plans to keep the car until it fails, with interest in upgrading to a Model S for its enhanced design.

Bitcoin's Unstoppable Decentralization

In this episode, uncover how Bitcoin thrives in distrustful environments, forcing transparency on users while enabling seamless, decentralized transactions—key for tech-driven futures like AI agents.

Key Takeaways

Bitcoin operates on a peer-to-peer network where nodes gossip transactions, ensuring consensus without central authority.

Decentralization means users vote via software choices, preventing any single group from altering core rules like the fixed supply.

Forks allow network evolution, but hard forks create separate chains, with market forces deciding winners.

Security relies on hash rate growth, making attacks like 51% infeasible due to massive capex and chip bottlenecks.

Lightning Network enables instant off-chain payments, scaling Bitcoin for everyday use without trusting intermediaries.

Institutional adoption is inevitable, but self-custody beats paper Bitcoin for true control and verifiability.

Quantum threats are addressable via protocol upgrades, with existing resistant algorithms in development.

Bitcoin's protocol enforces a fixed 21 million supply, issued predictably through mining rewards that halve periodically. Nodes validate every transaction, creating an immutable ledger viewable by anyone running the software. This setup contrasts with fiat systems, where central banks manipulate supply via printing. As hash rate surges, network security strengthens, deterring attacks—current estimates peg a 51% assault at $70 billion in upfront costs plus daily electricity bills, requiring years of chip dominance. Forks demonstrate resilience: disagreements lead to splits like Bitcoin Cash, but the original chain prevails through user consensus. Lightning builds on this by chaining bar tabs into instant, low-fee payments, ideal for AI economies needing trustless value exchange. Overall, Bitcoin's anti-fragile nature grows from challenges, positioning it as a global store of value immune to political interference.

Robo-Taxi Revolution: Tesla vs. Waymo in Austin

In this episode, tech enthusiasts dive into the future of transportation with a firsthand look at robo-taxis in Austin. The discussion compares Tesla’s cutting-edge autonomous vehicles with Waymo’s offerings, highlighting the seamless experience, cost advantages, and the path to scaling driverless tech. A tour of Tesla’s data center reveals the power of their vertical integration, setting a high bar for competitors.

Key Takeaways

Tesla’s robo-taxis offer smoother, safer rides than Waymo, with fewer navigation quirks.

Tesla’s flat fee pricing undercuts Uber, making it a cost-effective option.

Waymo struggles with scale, limited by vehicle production and reliance on partnerships like Uber.

Tesla’s vertical integration, from chip design to software, positions it for rapid expansion.

Consumer preference leans toward autonomous vehicles for privacy and comfort.

The episode captures the excitement of riding in Tesla and Waymo robo-taxis, with Tesla’s rides feeling polished and reliable, navigating construction and traffic with ease. Waymo, while competent, shows occasional hiccups, like unnecessary stops, and faces challenges scaling due to limited vehicle production (2,000 cars projected by 2026). Tesla’s ability to deploy software updates across thousands of vehicles and its in-house chip and server designs give it a clear edge. The discussion also touches on market dynamics, noting Waymo’s lead over Lyft in San Francisco but highlighting Tesla’s potential to dominate as it expands. The episode wraps up with a look at the broader implications: as autonomous vehicles become normalized, companies like Uber and legacy automakers face growing pressure.

Tesla's Vision and Bitcoin's Role in Future Wealth

Cern Basher joins us to dive into Tesla's pioneering role in AI, autonomous vehicles, and sustainable energy, while exploring Bitcoin's transformative potential as a store of value. The discussion unpacks how Tesla's vision aligns with a future where digital assets like Bitcoin could redefine wealth preservation amidst global economic shifts.

Key Takeaways

Tesla's leadership drives innovation in AI, autonomous transport, and sustainable energy, positioning it as a tech powerhouse.

Bitcoin is presented as a superior store of value, outpacing traditional assets like gold and fiat currencies over time.

Currency debasement erodes purchasing power, with examples like the US dollar losing 65% of its value in 30 years.

Bitcoin's security protocol, backed by immense computing power, makes it a robust defense against cyber threats.

Historical skepticism toward innovations like Amazon mirrors initial doubts about Bitcoin, yet both have proven resilient.

The episode highlights Tesla's forward-thinking leadership, emphasizing its advancements in AI, autonomous transportation, and sustainable energy as a beacon for tech enthusiasts. The conversation then pivots to a critical examination of money, using the historical example of the Island of Yap’s stone money to illustrate how societies assign value. This sets the stage for discussing modern currency issues, such as inflation and debasement, which diminish purchasing power—evidenced by the US dollar’s 65% value loss over three decades. Bitcoin emerges as a compelling solution, with its finite supply of 21 million coins and decentralized, energy-intensive proof-of-work system ensuring security. The discussion draws parallels with past skepticism toward Amazon, noting how Bitcoin, once dismissed, has grown into a $2.4 trillion asset. The episode also explores Bitcoin’s potential as a cybersecurity protocol, citing Jason Lowry’s thesis that frames it as a “weapon system” for protecting digital assets. As Tesla and other companies consider Bitcoin for treasury reserves, its role in a future of AI-driven abundance and economic disruption becomes clear, offering a hedge against fiat currency’s fragility.

Tesla's Robot Revolution Unleashed

In this episode, Cern Basher, uncovers how Tesla's humanoid robots and robo-taxis promise trillion-dollar disruptions, revealing why visionary leadership trumps quarterly forecasts and creates unbeatable moats through relentless first-principles execution.

Key Takeaways

Humanoid robots represent Tesla's core long-term value, with scalable unit economics projecting massive profits at high production volumes.

Robo-taxis follow closely, unlocking autonomous mobility markets ripe for transformation.

Wall Street's short-term focus consistently misses explosive growth in innovators like Tesla and Nvidia, favoring immediate results over future potential.

Retail investors excel by understanding deep tech narratives, testing theses patiently, and embracing high-risk, high-reward opportunities.

Exceptional leaders build moats by tackling unsexy, monumental challenges, fostering innovation that incumbents can't match.

First-principles thinking prioritizes mission-critical features, enabling breakthroughs in EVs, rockets, and beyond.

Tesla's trajectory hinges on disrupting stagnant industries through advanced robotics and autonomy. Economic modeling by Basher highlights humanoid bots generating substantial per-unit profits once scaled, assuming millions produced annually. Robo-taxis amplify this by tapping into untapped mobility demands. Critics overlook these due to non-existent products lacking immediate demand data, yet historical precedents like reusable rockets and mass EVs prove visionary bets pay off. Retail edges Wall Street by prioritizing long-term theses over quarterly pressures, leveraging community insights and patience. Leadership quality drives success, as seen in firms betting on people over pure numbers. Embracing painful innovation builds enduring advantages, while singular focus on essentials—like superior driving experiences—ensures dominance.

Art Laffer on Taxes, Tariffs, and Economic Growth

Uncover the economic truths behind tax policies and trade strategies that fuel prosperity, as Art Laffer shares data-driven insights on growth.

Key Takeaways

Higher tax rates on top earners often cut revenue and hurt economic performance.

Lower tax rates on the wealthy boost revenues and benefit lower-income groups.

Tariffs can disrupt trade gains but may be used strategically to ensure fair global markets.

Growth thrives on low taxes, spending restraint, sound money, minimal regulation, and free trade.

Income redistribution reduces total output, with full equality leading to zero income.

Art Laffer draws on U.S. tax history from 1913 to show that high rates, like those in the 1930s–1970s, stifled growth and worsened inequality by curbing incentives. Kennedy’s tax cuts and Reagan’s reforms sparked booms, while protectionist moves like the Smoot-Hawley Tariff fueled downturns. Modern tariffs, flexible and leveraging U.S. market power, can push for reciprocal trade. Focusing on five macroeconomic pillars—low taxes, spending control, sound money, light regulation, and free trade—drives sustainable growth, sidelining deficit concerns.

TESBROS: DIY Tesla Wrap Kits Unveiled in Chattanooga

In this episode, dive into the world of TESBROS, a Chattanooga-based company revolutionizing Tesla customization with DIY wrap kits. From their origins in 2018 to creating user-friendly paint protection film (PPF) and vinyl kits, Tesbros empowers car enthusiasts to personalize their vehicles affordably, with a focus on quality and community-driven innovation.

Key Takeaways

TESBROS started in 2018, inspired by the need for better Tesla accessory solutions.

Their DIY kits include everything needed for vinyl and PPF wraps, designed for beginners.

Kits feature pre-cut films, tools, and slip solutions, with a course for guidance.

They prioritize customer experience with vertical integration and real human support.

Expanding beyond Tesla, with Rivian kits and more planned soon.

TESBROS began when its founder, inspired by his 2018 Tesla Model 3, identified gaps in the customization market. Initially a blog sharing Tesla insights, it evolved into a business offering DIY wrap kits for Tesla models like the Model 3, Model Y, and Cybertruck. These kits, developed through meticulous scanning and design, cater to beginners by including pre-cut PPF or vinyl, tools like squeegees and heat guns, and even pre-measured slip solutions to eliminate guesswork. Their vertically integrated approach ensures quality control and rapid iteration based on customer feedback, such as adding extra material for Cybertruck kits. A standout feature is their online course, tailored to guide users through the installation process, making it approachable for novices. Tesbros also fosters community engagement through a Facebook group for real-time support. The episode showcases a Cybertruck wrap with a subtle embossed logo in frozen lily PPF, highlighting their focus on durability and aesthetics. With plans to expand to Rivian and other brands, TESBROS is redefining vehicle customization for tech enthusiasts.

AI's Hype vs. Reality: Future Disruptions

In this episode, uncover AI's true trajectory: overhyped short-term gains mask profound long-term transformations, including physical world disruptions and evolving human roles.

Key Takeaways

AI struggles with scalable, repetitive tasks today, requiring extensive human oversight and scaffolding.

Long-term evolution mirrors biology, building advanced reasoning on foundational intelligences yet to be developed.

Economic models face disruption from robo-taxis and humanoid bots, potentially leading to deflation and redefined wages.

Workforce shifts prioritize human-centric fields like sports, entertainment, and exploration amid automation.

Societal changes include rising faith-based communities and new economies focused on scarce resources like attention and land.

Dive deeper into AI's current hurdles, where brilliance flashes but consistency demands heavy engineering, akin to early internet development. Progress feels incremental, with digital applications limited compared to vast physical opportunities like autonomous construction or Mars habitats. Investments pour in assuming quick returns, yet realities like energy and compute constraints slow sudden breakthroughs. Disruptions unfold gradually, starting in unregulated sectors, displacing jobs but potentially creating abundance through cheaper goods. Future economies center on irreplaceable human elements—intense competitions, real-time betting, interstellar ventures—while addressing risks like inequality through mechanisms resembling UBI. Amid uncertainty, optimism hinges on adaptive frameworks, reversing trends toward faith for meaning in an automated world.

Tesla Shifts AI Strategy: DOJO Scaled Down for AI6 Focus

In this episode, we dive into Tesla’s bold decision to scale back its DOJO supercomputer project, redirecting efforts toward AI6 chips in partnership with Samsung. This strategic shift highlights Tesla’s focus on overcoming AI validation challenges and securing chip supply amidst global uncertainties, offering key insights for tech enthusiasts tracking AI and automotive innovation.

Key Takeaways

Tesla is winding down the DOJO project, originally an insurance policy against Nvidia’s dominance, to focus on AI6 chips.

AI6 will integrate training and inference, streamlining Tesla’s AI architecture for faster validation cycles.

The shift to Samsung for AI6 production reduces reliance on TSMC, mitigating supply chain risks amid geopolitical concerns.

Validation, not training, is the current bottleneck for Tesla’s Full Self-Driving (FSD) and robotaxi development.

DOJO’s team expertise in exotic chip packaging is less relevant for AI6, leading to staff transitions and potential spin-offs.

Tesla’s DOJO project, launched around 2019 as a hedge against Nvidia’s AI chip dominance, aimed to build in-house supercomputing capacity for training AI models, particularly for video-heavy Full Self-Driving (FSD) data. However, the project underperformed compared to Nvidia’s robust CUDA ecosystem, which excels in coordinating massive AI training tasks. Tesla’s pivot to AI6 chips, developed with Samsung, reflects a strategic consolidation, merging training and inference capabilities into a single, versatile chip to accelerate FSD validation—a critical bottleneck. By moving away from TSMC’s advanced packaging, Tesla sacrifices cutting-edge chip designs for supply chain certainty, especially given potential geopolitical risks to TSMC’s Taiwan-based production. The AI6-focused DOJO 3 will likely power both in-vehicle inference and data center validation, aligning with Tesla’s broader AI ambitions, including Optimus robotics and potential synergies with xAI’s massive Nvidia-based clusters. This move underscores Tesla’s adaptability in prioritizing practical, scalable solutions over ambitious but resource-intensive projects like DOJO.

Tesla's AI Strategy vs. NVIDIA's Dominance

Tesla's aggressive push into AI, from custom chips to autonomous driving, positions it as a formidable player against NVIDIA. Amit shares insights on why Tesla's ecosystem, paired with xAI and innovative energy use, could redefine the AI landscape.

Key Takeaways

Tesla's Samsung partnership for HW6 chips ensures manufacturing control, enhancing FSD and Optimus robot capabilities.

Distributed inference via Megapacks and Starlink could turn stored energy into AI compute, offering flexible monetization.

Robotaxi dynamic pricing yields 40 cents profit per mile at $1, undercutting Uber and signaling market disruption.

Dojo's video-specialized architecture taps infinite data, potentially surpassing NVIDIA's general-purpose chips.

xAI's Grok 4, outperforming GPT models, integrates with Tesla vehicles, boosting enterprise value through AI synergy.

Tesla’s chip strategy with Samsung secures supply chain autonomy, critical for scaling FSD and Optimus, which demand massive compute power. This move, while competitive with NVIDIA, addresses supply constraints as NVIDIA’s demand remains insatiable. Amit highlights Tesla’s potential to leverage its vast video data from vehicle cameras, feeding Dojo’s specialized architecture to build superior world models, unlike NVIDIA’s broader platform approach. If Dojo iterations close the gap, Tesla could save significantly on chip costs, even if trailing NVIDIA’s performance by 30%.

Energy innovation is pivotal, with Megapacks and vehicle batteries enabling distributed inference during downtime, connected via Starlink. This transforms energy into intelligent labor, far more adaptable than Bitcoin mining, addressing global supply-demand mismatches. Robotaxi economics further solidify Tesla’s edge, with dynamic pricing already outpacing Uber’s model. In San Francisco, Waymo’s premium-priced rides capture market share, hinting at Tesla’s potential to dominate at 20 cents per mile with Cybercab.

xAI’s rapid progress, with Grok 4 rivaling top models, enhances Tesla’s ecosystem by embedding advanced AI in vehicles, driving user engagement and stock valuation. Amit sees Tesla’s unique convergence of data, compute, and energy as a long-term bet, potentially pushing its market cap toward $10 trillion, challenging NVIDIA’s trajectory despite its current $4 trillion valuation.

Tesla-Samsung AI Chip Partnership

This partnership unlocks scalable AI hardware that integrates processing, memory, and networking on massive panels, enabling seamless training of multimodal models on video, audio, and text data—key for real-world autonomy and robotics.

Key Takeaways

AI6 chips support both training and inference on the same architecture, mirroring brain-like efficiency and slashing costs through unified production.

Wafer-scale tiles evolve to rectangular panels for Dojo 3, packing 512 chips into superchips that boost data flow and thermal management for trillion-parameter models.

Distributed compute via robotaxis and energy storage turns idle vehicles into a global inference cloud, layering revenue from transport, energy, and AI queries.

Samsung's Texas fab ensures supply chain resilience, decoupling from Taiwan risks while leveraging Tesla's design input for custom 2.5D/3D packaging.

AI demand accelerates sustainable energy, with solar and batteries powering terawatt-scale compute at near-zero marginal cost.

The discussion dives into chip evolution, where parallel processing outpaces Moore's Law, delivering 100x gains in compute per watt through integrated boards that minimize latency. From Dojo's video-optimized training to edge inference in Cybercabs, the focus is on modularity: produce versatile AI6 units deployable in cars (two for redundancy), bots, or mega training clusters. Samsung's role addresses TSMC bottlenecks, prioritizing Tesla's volume for faster ramps and cost edges—potentially halving data center builds. Broader implications tie into embodied AI, where Tesla's full-stack control (hardware, software, energy) creates capital-efficient platforms like robotaxis generating $100K annual revenue while idling as compute nodes. Energy integration is pivotal: excess solar powers inference at remote sites, turning stranded renewables into profitable work. Health detours highlight blood sugar stabilization via ketosis and vinegar hacks for sustained focus, but the core stays on AI's trajectory toward swarm learning and physics-discovering models by 2025.

Tesla's AI6 Chip Revolution and Supply Chain Mastery

Dive into Tesla's bold moves in AI hardware and supply chains, revealing how partnerships and vertical integration position the company at the forefront of robotics and autonomous tech. Gain insights into the economic and strategic advantages driving these developments.

Key Takeaways

Tesla's $16.5B Samsung deal secures priority access to a Texas fab for AI6 chips, enabling high-yield production for diverse uses.

AI6 supports robo-taxis, humanoids, and data centers, providing redundancy and massive growth potential across industries.

Partnerships with LG add battery capacity, emphasizing Tesla's expertise in integration to avoid issues like fires seen in competitors.

Localizing manufacturing in the US reduces latency, enhances security, and leverages the CHIPS Act for competitive edge.

Humanoids face challenges in actuators, precision, and power, but Tesla's OS for manufacturing sets it apart in scaling production.

Supplier relationships thrive on Tesla's demand certainty, creating win-win dynamics and negotiation leverage.

Tesla's AI6 chip emerges as a cornerstone for multiple high-growth sectors, with applications spanning inference in vehicles and robots to training in data centers. The Samsung partnership, starting at $16.5B, dedicates a Taylor, Texas fab to Tesla, ensuring priority and high utilization while avoiding bottlenecks. This mirrors Apple's silicon strategy, optimizing hardware-software integration for superior performance at lower costs. LG's $4B deal bolsters battery supply, highlighting Tesla's pack design prowess. Broader trends include deglobalization, driven by tariffs and tensions, prompting US reindustrialization—exemplified by Starlink's Bastrop factory. Discussions extend to potential drone ventures, blending Tesla's AI navigation with SpaceX avionics, though focus remains on core products. Humanoids promise disruption but require solving dexterity, repeatability, and geopolitical hurdles. Overall, Tesla's flywheel—fueled by visionary leadership—turns uncertainty into supplier loyalty, accelerating innovation in AI factories and beyond.

Tesla Robotaxi Expands to Bay Area

Tesla's Robotaxi expansion into the Bay Area marks a pivotal shift in autonomous ride-hailing, outpacing competitors in scale and pricing while leveraging AI for swift deployment.

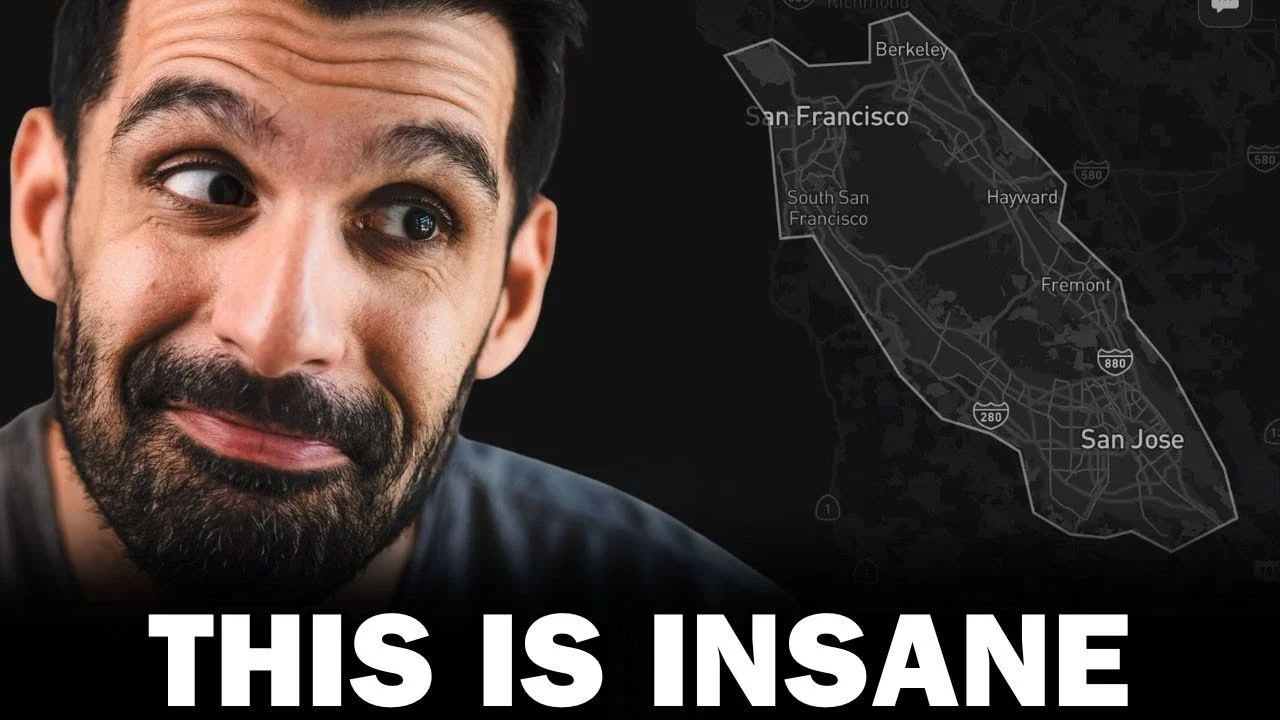

Key Takeaways

Bay Area geofence covers populous cities like San Jose and Berkeley, serving about 7 million people—far larger than Austin's initial rollout.

Tesla's coverage exceeds Waymo's operational zones, starting with safety drivers as required by California regulations.

Pricing starts at roughly $1 per mile, undercutting Uber, Lyft, and Waymo's $2–3 rates, enabling market disruption.

Operational costs drop to 61–85 cents per mile without drivers, yielding profits at current pricing with efficient teleoperation.

Hiring in multiple states hints at nationwide expansion, powered by Tesla's manufacturing capacity of 3,000–5,000 vehicles daily.

The Bay Area launch builds on Austin's driverless model but incorporates safety drivers initially, mirroring Waymo's regulatory path. This allows Tesla to flood the market with affordable rides, gathering data for full autonomy. With end-to-end AI and low-cost hardware, Tesla can deploy fleets rapidly, potentially displacing traditional services. Profitability emerges post-driver removal, with teleoperator ratios optimizing margins. Broader implications include transforming delivery, airport transport, and even challenging car ownership, all while prioritizing safety to avoid setbacks seen in competitors.

Epstein Blackout: Media, Policy, and Politics

Dive into the shadowy intersections of media silence, political maneuvering, and technological shifts that could redefine U.S. governance, offering fresh perspectives on transparency, foreign influence, and economic priorities.

Key Takeaways

Epstein allegations suggest intelligence ties influencing current foreign policy decisions, particularly with allies like Israel.

Trump's major tax and spending bill passed amid scandals, but media focus on Epstein overshadows economic wins like manufacturing incentives.

Independent media fosters deeper discussions on systemic issues, challenging mainstream narratives and building public awareness.

Congressional dysfunction stems from delegated powers to agencies, leading to omnibus bills and eroded legislative muscle.

Elon Musk could impact politics by funding deficit-focused candidates in House primaries, creating influential voting blocs.

Democrats face midterm challenges due to low approval on key issues and lingering COVID policy resentments.

AI disruptions may fuel demands for systemic change, potentially increasing political engagement or apathy.

The discussion unpacks how the Epstein case, revealed through credible outlets, points to potential foreign intelligence leverage over U.S. decisions, especially in regions like Iran and Ukraine. Against this, the Trump administration secured a sweeping bill blending tax reforms, spending cuts, and immigration measures, yet public frustration grows over transparency lapses. Independent platforms enable nuanced explorations of these topics, contrasting with traditional media's surface-level coverage. Broader systemic flaws emerge: Congress's reliance on executive agencies hampers consensus-building, resulting in bloated legislation. Speculation on Musk's involvement highlights strategies for fiscal reform via targeted political funding. Democratic woes, amplified by COVID-era policies, signal voter disillusionment, while AI's impending job shifts could spark a reevaluation of economic structures. Overall, the conversation balances pessimism over cultural decay with optimism from tech-driven abundance.

Tesla Robotaxi Austin Expansion & AI Insights

Discover Tesla's rapid Robotaxi rollout in Austin, unlocking practical urban mobility while exposing gaps in competitors like Waymo. Gain insights into AI-driven ecosystems reshaping transportation and tech giants' trajectories.

Key Takeaways

Tesla's geofence expansion enables seamless suburban-to-urban rides, reducing costs and boosting user productivity.

Robotaxi outperforms supervised FSD by allowing full passenger focus on tasks like research or content creation.

Apple's AI integration lags, risking ecosystem dominance amid shifts to multimodal AI and new interfaces.

Highways and larger fleets signal Tesla's path to statewide coverage, outpacing rivals in scalability.

AI ecosystems like Grok in vehicles pave the way for personalized, cross-device memory and long-distance autonomous travel.

Emerging tech like drone and underground delivery complements Robotaxi, slashing costs for lightweight goods.

Automation promises cheaper services but demands societal solutions for job displacement through temporary redistribution.

Tesla's Robotaxi service has evolved from novelty to utility, with recent Austin expansions covering key areas like Georgetown and Bastrop. Rides now cost around $14 total, adding minimal time compared to personal driving while freeing users for work. Geofencing shapes suggest deliberate, flexible mapping for maximum impact, potentially encompassing the full city soon. Validation in areas like Kyle hints at highway integration, enabling factory access and broader metro connectivity. This scalability contrasts with Waymo's slower growth, positioning Tesla for dominance in transportation-as-a-service models, including memberships for unlimited rides. Integrating Grok enhances vehicles with persistent AI memory, bridging cars, apps, and future devices for seamless experiences. Broader implications include AI's role in ecosystems, where pace of innovation trumps initial leads—evident in Apple's stalled OS-native AI amid talent losses and conservative strategies. Predictions foresee Apple facing hostile takeovers or stagnation as valuations shift to agile players. Innovations in physical e-commerce, like silent drone drops for 5-pound packages or high-speed underground robots, reduce delivery friction using batteries and autonomy. Overall, AI's physical world disruption starts with Robotaxi, promising efficiency but requiring balanced policies to redistribute gains from automation.

Michael Gorton's Maverick Journey: From ISP to Telemedicine

Dive into the extraordinary life of Michael Gorton, a serial entrepreneur who built one of the first internet service providers (ISPs), pioneered telemedicine with Teladoc, and faced down the DEA to change healthcare. With degrees in engineering, physics, and law, Gorton’s story is a masterclass in resilience, innovation, and visionary leadership that tech enthusiasts will find inspiring.

Key Takeaways

Pioneered one of the first ISPs in the 1990s, scaling it to a $122 million acquisition.

Founded Teladoc after a Kilimanjaro epiphany, transforming healthcare access.

Overcame regulatory battles, including a DEA raid, to legitimize telemedicine.

Authored bestselling books, including historical fiction and telemedicine histories.

Mentors entrepreneurs and draws inspiration from figures like Leonidas to lead with purpose.

In this episode, we explore Michael Gorton’s remarkable career, from his early days as an Air Force brat to becoming a trailblazer in tech and healthcare. Gorton’s journey began with a childhood dream of walking on Mars, inspired by Apollo astronauts and a mentor who helped him craft a life plan. This led to degrees in engineering, physics, and law, which he leveraged to innovate at a power company, automating meter reading in the 1980s. His entrepreneurial spirit took flight with Internet Global, one of the first ISPs, where he introduced voice-over-IP and DSL, scaling the company until its $122 million acquisition in 2000. A near-miss with the dot-com crash didn’t deter him; instead, it fueled his next venture.

While climbing Kilimanjaro, Gorton witnessed a colleague treating patients remotely via satellite, sparking the idea for Teladoc. Launched in 2002, Teladoc faced fierce resistance from medical boards and a dramatic DEA raid in 2005, suspecting illegal prescriptions. Gorton’s team, inspired by his “Leonidas mindset” of fighting for a cause, persevered, proving telemedicine’s value and paving the way for its 2015 IPO. Beyond entrepreneurship, Gorton is a bestselling author, weaving complex science into accessible stories, and a mentor to the next generation. His story is a testament to turning bold ideas into reality against all odds.