The Future Is Now: Why Customer Needs and AI Will Shape Tomorrow

Unpacking the Power of Long-Term Thinking and Technological Revolution

The world is changing at breakneck speed, driven by transformative technologies like artificial intelligence (AI) and space exploration. Yet, amid this whirlwind, one thing remains constant: the enduring power of customer needs. By anchoring strategies in these unchanging desires and harnessing the potential of AI and other innovations, businesses and entrepreneurs can build a future that’s not only sustainable but revolutionary. From AI’s universal impact to the promise of space as a new frontier, here’s why now is the most exciting time to be a creator, thinker, or founder.

Key Takeaways

Customer needs are timeless: Focusing on stable customer desires, like fast delivery or reliability, creates durable business strategies.

AI is a game-changer for all industries: Beyond startups, AI will boost quality and productivity across every sector, from manufacturing to hospitality.

Space is the next frontier: From lunar resource harvesting to gigawatt-scale data centers in orbit, space will redefine how we live and work.

Innovation requires harmony: Balancing exploration (wandering) with disciplined execution drives breakthroughs without overwhelming organizations.

Bubbles don’t negate progress: Industrial bubbles, like today’s AI frenzy, fund both good and bad ideas but often yield lasting societal benefits.

Tesla's Budget EV Breakthrough: The Affordable Model Y Uncovered

Revamping Accessibility in Electric Vehicles Amid Shifting Incentives

Spy shots from Texas highways and firmware leaks have pulled back the curtain on Tesla's push for a more budget-friendly Model Y variant. This stripped-down crossover targets everyday drivers by trimming premium features while keeping the essentials intact, all to maintain production momentum and gather vast amounts of driving data for advancing full self-driving tech.

Key Takeaways

Tesla's affordable Model Y features simplified exterior elements like no front or rear light bars, a front bumper camera, and smaller 18-inch wheels for better efficiency.

Interior cuts include no glass roof, no rear screen, cloth or basic vegan leather seats without ventilation, and a basic audio system to reduce manufacturing costs.

Expected pricing lands between $35,000 and $40,000, making it competitive without relying on expired US EV tax credits.

Production ramps up in the second half of 2025, with rear-wheel-drive as the base option and potential all-wheel-drive upgrades.

This model supports Tesla's strategy to flood roads with vehicles, accelerating data collection for autonomous systems and software revenue.

The Money Game: How NIL is Reshaping College Football’s Soul

Unprecedented wealth is flooding into college athletics, but at what cost to players, coaches, and the sport’s future?

The introduction of Name, Image, and Likeness (NIL) deals and revenue-sharing models has transformed college football into a financial juggernaut, with top athletes earning millions before they even graduate. This seismic shift has brought newfound wealth to young players, but it’s also unleashed a torrent of challenges—psychological pressures, mismanaged expectations, and a fractured system struggling to keep up. For tech enthusiasts who thrive on understanding disruption, the NIL era is a masterclass in how money can upend tradition, alter incentives, and reshape an entire industry. Let’s dive into the chaos, the consequences, and what it means for the future of college football.

Key Takeaways

Massive Earnings, Massive Pressure: Top college athletes are earning $1M-$5M annually through NIL deals and revenue sharing, creating intense expectations and psychological strain for players as young as 18.

Coaching Challenges Amplified: Coaches now juggle roster management, donor relations, and player psychology, acting as financial advisors and therapists in a professionalized landscape.

Systemic Instability: The NCAA’s lack of authority, coupled with inconsistent oversight (e.g., NIL Go portal delays), has created a Wild West where rules are ignored, and workarounds are common.

Financial Mismanagement Risks: Many young athletes, lacking financial education, face pitfalls like overspending on liabilities (e.g., luxury cars) or tax issues, threatening their long-term wealth.

Cultural Shift in Motivation: The influx of money has shifted player priorities from legacy and passion to financial security, potentially fostering complacency and reducing on-field performance.

Program Sustainability at Risk: Donor fatigue and budget cuts in athletic departments signal an unsustainable model, with private equity looming as a potential game-changer.

The NIL Revolution: How Sudden Wealth is Reshaping College Football's Future

Why the 2024 season's chaos isn't just about upsets—it's a symptom of deeper financial and mental shifts in the sport.

College football in 2024 has delivered nonstop surprises, from unexpected losses to underperforming powerhouses. Beneath the surface, the introduction of Name, Image, and Likeness (NIL) deals and revenue sharing has transformed the game into a high-stakes business arena. Players now earn millions before turning pro, but this influx of cash brings psychological pressures, financial pitfalls, and operational headaches that are testing teams, coaches, and the entire ecosystem. For fans and observers, understanding these dynamics reveals why the sport feels more unpredictable than ever—and what it might mean long-term.

Key Takeaways

NIL deals have created a free-agency-like environment where five-star recruits can command over $2 million, leading to complacency and overthinking among players who feel they've "made it" early.

Psychological warfare is real: Young athletes face immense pressure from family demands, donor expectations, and social media scrutiny, often without adequate financial education, resulting in mismanagement like excessive car leases and tax issues.

Coaching decisions are complicated by money—bench a high-paid starter for a cheaper backup, and you risk alienating donors who funded the deal, potentially cutting future contributions.

Revenue sharing caps (around $20 million per athletic department) aim to level the playing field but are easily bypassed through outside donors and front-loaded payments, fueling roster instability.

The NCAA's weakened authority has turned college athletics into a Wild West, with private equity eyeing investments to stabilize unsustainable donor-reliant models.

Programs like Penn State exemplify the transition pains: Rebuilding from past scandals while navigating NIL could lead to leadership shakeups if expectations aren't met.

Future outlook: Expect more GM roles in teams, agent incompetence driving bad deals, and a potential talent pipeline shift to the NFL as players prioritize money over development.

Tesla’s Q3 Triumph: Record Deliveries, AI Ambitions, and a Path to Affordable EVs

Why Tesla’s third quarter signals a bold pivot to AI-driven growth and mass-market appeal

Tesla’s third quarter of 2025 delivered a stunning performance: over 497,000 vehicles delivered, 447,000 produced, and a record 12.5 gigawatt-hours of energy storage deployed. These numbers not only defy skeptics who predicted Tesla’s decline but also highlight a strategic shift toward inventory management, cost reduction, and a future powered by autonomous driving and affordable vehicles. For tech enthusiasts, this moment underscores Tesla’s evolution from a carmaker to a physical AI powerhouse with ambitions far beyond traditional automotive.

Key Takeaways

Record-Breaking Quarter: Tesla delivered 497,000 vehicles and deployed 12.5 GWh of energy storage, marking a high for both metrics.

Inventory Strategy Shift: Delivered 50,000 more vehicles than produced, reducing built-up inventory and leveraging the expiring U.S. EV tax credit.

Affordable EVs on Horizon: Plans for a more affordable Model Y and Model 3 with reduced features to hit a 3-million-vehicle annual production goal.

FSD as a Game-Changer: Full Self-Driving (FSD) version 14 aims for unsupervised driving, potentially making Tesla’s vehicles a compelling alternative to traditional cars.

AI and Robotics Vision: Tesla’s driverless network and upcoming Cybercab and Semi projects position it to dominate AI-driven mobility, outpacing competitors like Uber.

Financial Strength: Expected to add $3.5–5 billion in cash from operations, with high-margin energy storage (30%) boosting profitability.

Tesla's Epic Comeback: Record Deliveries Signal a New Era in EVs

Why Tesla's Q3 2025 Could Redefine the Auto Industry's Future

Tesla stands on the brink of its largest quarter yet, with delivery numbers poised to shatter records and margins climbing back toward healthier levels. As EV demand evolves without federal tax credits, the company is shifting gears toward affordable options and advanced autonomy, even as rivals like BYD face their first sales dips in years. This moment highlights Tesla's resilience in a volatile market, offering fresh opportunities for growth through software and innovative vehicles.

Key Takeaways

Tesla's Q3 2025 deliveries are forecasted at 512,000 units, surpassing the previous record of 495,000 from Q4 2024.

Gross margins could rebound to around 17% or higher, thanks to high volume and minimal price cuts, driven by urgency around the expiring EV tax credit.

Competitors like BYD are experiencing their first year-over-year sales decline in five years, amid supply chain strains and reduced subsidies.

Tesla plans to introduce more affordable models, potentially stripped-down versions of the Model 3 or Y, sold at cost with profits from recurring software like Full Self-Driving (FSD).

Upcoming FSD V14 promises unsupervised driving, a massive leap that could generate thousands in annual revenue per vehicle through subscriptions.

The Cybercab, a fully autonomous vehicle without steering wheel or pedals, represents Tesla's long-term vision, though regulatory hurdles limit near-term sales.

Tesla's FSD V14: On the Verge of Sentient Autonomy

Unlocking Driverless Freedom and Massive Scale in Robotaxis

Tesla stands at the edge of a major breakthrough with its Full Self-Driving software, where vehicles could soon handle complex real-world scenarios with human-like intuition. This update promises to boost safety far beyond current levels, enable hands-off driving for owners, and accelerate the expansion of autonomous ride-hailing networks.

Key Takeaways

Tesla plans to roll out FSD V14 in stages, starting with an early wide release next week, followed by V14.1 in about two weeks, and V14.2 soon after, where the system may exhibit near-sentient behavior.

The update increases parameters by roughly 10 times, allowing the AI to process more variables for nuanced decision-making in unpredictable situations.

Safety could reach 2-3 times better than human drivers, or even up to 10 times, potentially meaning accidents only every 1-5 million miles.

Existing Tesla owners with Hardware 4 could access unsupervised driving via software updates, possibly at a premium monthly fee around $99-200.

The same technology will power Tesla's robotaxi fleets in locations like Austin, the Bay Area, and Arizona, enabling rapid scaling with minimal human oversight.

Higher safety reduces the need for remote operators, potentially allowing one overseer per 1,000 vehicles at 10x human safety levels.

This positions Tesla to undercut competitors like Uber with operating costs as low as 40 cents per mile, driving massive market disruption.

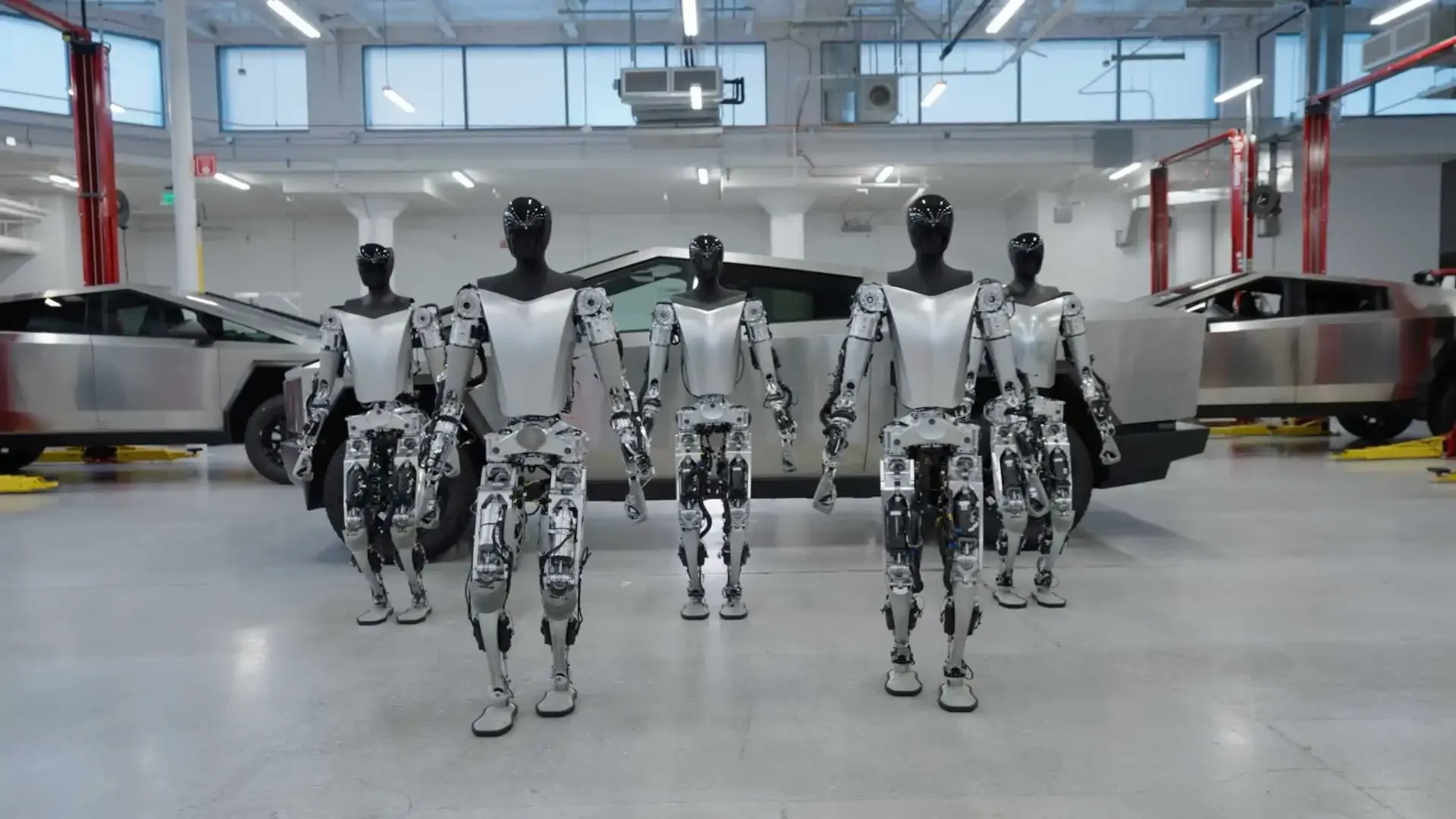

Tesla's AI Revolution: From Wheels to Humanoids

Redefining Mobility, Labor, and the Global Economy

Tesla's push into embodied AI isn't just incremental innovation—it's the catalyst for entirely new markets worth trillions, from autonomous fleets to robots handling everyday tasks. Dive into how this technology could generate unprecedented wealth while reshaping society, and why owning a piece of it might be the smartest move for the coming decade.

Key Takeaways

Tesla's vehicles serve as the entry point for widespread AI adoption, evolving from simple cars to intelligent systems capable of full autonomy.

Robotaxis are poised for rapid scaling, potentially undercutting traditional ride-sharing with costs below $1 per mile and immediate profitability.

Humanoid robots like Optimus could handle 50-80% of physical labor by 2030, creating a $40 trillion market and enabling new applications from factories to Mars exploration.

Wall Street is beginning to recognize Tesla's AI potential, with valuations reflecting future robotaxi and robotics revenues rather than current auto sales.

Societal shifts may require universal basic income to address job displacement, ensuring broader access to AI benefits and mitigating inequality.

Investing in Tesla stock offers a straightforward path to participate in AI-driven wealth creation, despite short-term volatility and high valuations.

The Embodied AI Boom: Tesla's Path to a Trillion-Dollar Future

Why Sentient Machines on Wheels Could Redefine Wealth, Work, and Society by 2030

Tesla's evolution from electric vehicles to AI-powered robots signals a massive shift in how we move, work, and live—opening doors to new markets worth trillions while challenging us to adapt to an era of abundant intelligence.

Key Takeaways

Tesla's vehicles serve as a gateway to embodied AI, where cars act as intelligent robots collecting data to fuel broader innovations in autonomy.

Robotaxis are poised for rapid scaling, potentially generating immediate profits by undercutting ride-sharing costs and creating entirely new business models like mobile services.

Humanoid robots could handle 50-80% of physical labor, unlocking a $40 trillion market that expands further with infinite supply, but prices may start high before dropping to accessible levels.

Wall Street is slowly recognizing Tesla's AI potential, with valuations likely to surge ahead of actual business maturation, supporting market caps in the trillions.

Societal transitions from AI disruption may require tools like universal basic income funded by robot taxes, alongside a focus on meaning and opportunity in a post-labor world.

By 2030, embodied AI could enable robots on Mars, factory automation at scale, and personalized services, but success hinges on affordable access to bridge wealth gaps.

Investing in Tesla offers a straightforward way to participate in this wealth creation, as the company pioneers scalable, low-cost AI hardware.

The Money Trap: How Broken Currency Fuels Global Chaos and Why a Digital Fix Could Change Everything

Unveiling the hidden forces behind economic inequality, endless wars, and societal decay—and the tech innovation poised to rewrite the rules.

Inflation isn't just a headline—it's a silent thief eroding your future. Imagine a world where prices naturally drop as innovation thrives, families afford homes on a single income, and governments can't fund endless conflicts by printing cash. This newsletter dives into the flaws of modern money systems and explores a groundbreaking digital alternative that's already reshaping global finance.

Key Takeaways

Modern fiat currencies allow unlimited printing, leading to hidden theft through inflation that devalues savings and forces people to work harder for less.

Sound money systems promote deflationary pressures where prices fall and quality rises due to competition and innovation, benefiting everyone without government interference.

Broken money distorts economic signals, pulling resources toward government-linked sectors and creating inefficiencies like obesity epidemics, housing crises, and demographic declines.

A perfect money should be scarce, verifiable, divisible, portable, and censorship-resistant—qualities that gold approximated but modern digital solutions like Bitcoin perfect through technology.

Adopting superior money could separate finance from state control, fostering a human renaissance with reduced wars, greater individual empowerment, and long-term societal prosperity.

Global adoption of advanced money systems is inevitable, similar to the internet's rise, but we're still in the early stages—offering massive opportunities for those who act now.

The AI-Driven Future: Robots, Rockets, and Radical Economic Shifts

Unlocking abundance through automation—why humanoid bots and self-driving tech could reshape everything from factories to Mars colonies.

Automation technologies are advancing at a breakneck pace, promising to slash costs for labor and transportation while opening up entirely new frontiers. From factories running 24/7 to cities deploying robot fleets for public services, these developments could drive unprecedented economic growth. Yet they also raise pressing questions about job displacement and societal stability. Here's what tech enthusiasts need to know about the emerging landscape.

Key Takeaways

Humanoid robots are poised to handle tasks like assembly, delivery, and chores at a fraction of human labor costs, potentially dropping to $3-5 per hour equivalent over time.

Self-driving vehicles could reduce transportation expenses to under 40 cents per mile, enabling innovative business models like mobile salons or on-demand services that come directly to consumers.

High-volume production of robots, spurred by early adopters like space exploration programs, will lower unit costs to $20,000-30,000, making them accessible for widespread use in warehouses, manufacturing, and urban revitalization.

Mars colonization efforts will rely heavily on robot labor to build infrastructure in harsh environments, funded by satellite internet revenues and creating a feedback loop for tech scaling.

While new sectors emerge in AI maintenance, space tech, and customized services, significant job losses in driving and manual labor are likely, overlapping with existing economic frustrations and potentially fueling social tensions.

Governments and companies could deploy robot fleets to aid underserved communities, repairing infrastructure and boosting local economies without ongoing wage expenses.

Elon Musk's Next Big Move: Acquiring Apple to Ignite the AI Revolution

Revolutionizing Personal Tech with Secure Data, Robotics, and Space Ambitions

Imagine transforming a trillion-dollar tech giant from a comfortable cash machine into a powerhouse of AI innovation. Acquiring Apple could give Elon Musk access to billions of users' private data to build personalized digital twins, automate global manufacturing, and generate massive cash flows to fuel projects like autonomous vehicles and Mars exploration—all while doubling the company's value through bold reinvention.

Key Takeaways

Apple's innovation has stalled, with products like Vision Pro underperforming and reliance on incremental iPhone updates leading to stagnant growth.

The company's true asset is its ecosystem of over a billion users' private data, which could enable secure AI-powered digital twins for personalized experiences across devices.

Musk could gain control with a 10% stake, valued around $350 billion, by leveraging his companies' combined worth, investor alliances, and banking relationships.

Shifting manufacturing from China through automation would reduce dependencies, while integrating Musk's AI like Grok could supercharge Apple's hardware.

Redirecting Apple's $110 billion annual cash flow from buybacks and dividends to R&D could double revenues, fund ambitious ventures, and attract growth-oriented investors.

The Supersonic Tsunami: Tech's Relentless March Toward Abundance

Why AI and automation will redefine work, wealth, and human potential—and the bumpy road ahead

Technological progress accelerates at a pace that outstrips societal adaptation, creating both massive opportunities and risks of inequality. In the coming decades, AI-driven automation promises a world where tedious labor vanishes, costs plummet, and abundance becomes the norm. Yet the transition could widen wealth gaps and disrupt jobs, demanding new economic models like universal basic income to maintain stability.

Key Takeaways

Robots and AI will handle all repetitive and dangerous tasks, from mining to creative arts, leading to a society focused on meaningful pursuits like science and culture.

Manufacturing costs could drop to about a dollar per pound for everything, making goods as affordable as basic agriculture products today.

Winner-take-all dynamics in AI-dominated industries will polarize wealth at national, corporate, and individual levels, necessitating policies like universal basic income to bridge gaps.

Starlink and similar technologies will connect 3 billion underserved people to the global economy, sparking innovation and entrepreneurship in remote areas.

Established companies rarely reinvent their core businesses; new entrants leveraging AI will disrupt legacy industries like automotive and aerospace.

Cities remain efficient hubs for innovation and resource use, countering trends toward remote work despite advances in connectivity.

Declining birth rates reduce societal investment in the future; technology must foster optimism to encourage family growth and long-term progress.

Mars colonization drives Earth-bound innovations in sustainable tech, from electric vehicles to alternative proteins, emphasizing in-situ resource use.

Humanoid robots will start in industrial settings for safety, evolving into shared urban resources that transform labor and daily life.

Tesla’s Energy Revolution: Mega Block and the AI-Powered Future

Why Tesla’s latest energy innovations are poised to reshape AI and global power grids.

The energy demands of artificial intelligence (AI) are skyrocketing, and Tesla is positioning itself at the forefront of this transformation with its upgraded Megapack and new Mega Block system. These advancements are not just incremental improvements—they’re strategic moves to address the massive energy needs of AI data centers and the broader shift toward decentralized, renewable-powered grids. Here’s why tech enthusiasts and investors should pay attention.

Key Takeaways

Tesla’s Mega Block enhances scalability: The new system integrates transformers and switchgear, reducing on-site assembly and boosting energy density by 20%, from 3.9 to 5 megawatt hours per unit.

AI is driving unprecedented energy demand: Data centers are scaling to gigawatt levels, with projections of 20–30 gigawatt facilities by 2030, creating a bottleneck in energy generation and storage.

Battery storage is critical for AI: Megapacks stabilize the erratic load profiles of AI data centers, protecting grids from sudden power swings and enabling off-grid solutions.

Decentralized energy is the future: Off-grid data centers using DC power from solar and batteries could bypass traditional grid bottlenecks, with Tesla leading the charge.

Transformers are a key bottleneck: Multi-year lead times for high-quality transformers make Tesla’s potential move to manufacture them a game-changer for rapid deployment.

Tesla's Robotaxi Surge: Nevada Green Light Accelerates Nationwide Rollout

Unlocking Driverless Highways and Smarter AI: How Tesla's Latest Approvals Could Redefine Urban Mobility

Tesla's autonomous driving push hits a milestone with Nevada's testing approval, paving the way for rapid expansion into permissive states. This move highlights key advantages in safety tech and regulatory navigation, setting the stage for scalable robotaxi networks that could outpace rivals by integrating highways and public access sooner.

Key Takeaways

Tesla secured approval from the Nevada DMV to test robotaxis on public roads, enabling operations without a driver in permissive environments similar to Texas.

Nevada's regulations require $5 million insurance and incident reporting but allow straightforward testing, mirroring Texas's hands-off approach that favors quick scaling.

Current robotaxi services in Austin cover 173 square miles, including highways with safety operators, while Bay Area operations span 400 square miles and aim for 100 driverless vehicles by month's end.

Upcoming FSD V14 software promises 2-3x human-level safety unsupervised, with a 10x parameter boost for fewer interventions and smoother performance.

Tesla's edge over competitors like Waymo lies in public highway access and open ridership, allowing faster data collection and service growth in states like Arizona and Florida.

Profitability from robotaxis may emerge in 2+ years, starting with 3:1 to 5:1 vehicle-to-supervisor ratios yielding 20-30% gross margins per unit.

Expansion targets half the U.S. population by year-end, leveraging an app-based waitlist to prioritize high-demand regions and build a nationwide network.

Bitcoin's Unstoppable Rise: Redefining Money in a Decentralized World

Decoding the Tech That Powers Trustless Finance

Bitcoin stands out as a system built for extreme distrust, where participants operate without needing to rely on each other. Its core design ensures that even adversaries can transact securely, making it a prime candidate for future economies driven by AI agents. Large-scale adoption by corporations and governments appears inevitable, driven by its fixed supply and transparency features that outshine traditional assets like gold.

Key Takeaways

Bitcoin operates on a decentralized network where users run nodes to verify transactions, ensuring no single entity controls the system.

The fixed supply of 21 million coins prevents inflation, contrasting with fiat currencies that expand through central bank policies.

Transparency comes from the public ledger, allowing anyone to verify holdings without trusting intermediaries.

Security relies on massive computational power, with attacks like gaining 51% of the hash rate requiring billions in investment and years of chip production.

Forks allow network evolution, but changes need widespread agreement, defaulting to the original hard money rules for stability.

The Lightning Network enables instant, low-cost payments by handling transactions off the main chain before final settlement.

Quantum computing poses risks to current cryptography, but resistant algorithms exist and are under development for integration.

Institutional involvement, such as ETFs, provides exposure but lacks the control and portability of direct ownership.

Bitcoin fosters optimism by protecting wealth from political interference, encouraging long-term planning over short-term survival.

Tesla’s Record-Breaking Q3 2025: Model Y Surge and FSD Ambitions

Why Tesla’s Third Quarter Could Redefine Electric Vehicle Dominance

Tesla is poised to deliver a blockbuster third quarter in 2025, with projections pointing to a record-breaking number of vehicle deliveries, driven by skyrocketing demand for the Model Y and strategic moves to capitalize on expiring U.S. tax credits. The company’s focus on Full Self-Driving (FSD) technology and production ramps signals a bold push to reclaim its edge in the electric vehicle (EV) market, even as competition intensifies. Here’s what tech enthusiasts need to know about Tesla’s trajectory and what’s fueling this comeback.

Key Takeaways

Record Delivery Projections: Analysts forecast Tesla will deliver around 488,000 vehicles in Q3 2025, potentially nearing 500,000, a new quarterly high, driven by strong Model Y demand.

Model Y Inventory Crunch: Low inventory levels, especially in the U.S., reflect surging demand, with some regions like Austin, Texas, reporting zero new Model Y stock within a 200-mile radius.

U.S. EV Tax Credit Impact: The impending expiration of the $7,500 federal EV tax credit on September 30, 2025, is spurring a rush of orders, with buyers securing binding purchase agreements to lock in savings.

Model Y L Success in China: The six-seater Model Y L has sold out for September 2025 in China, pushing delivery dates to October, highlighting robust demand in Tesla’s second-largest market.

FSD as a Game-Changer: Tesla’s advancements in Full Self-Driving (FSD) version 14, expected in late 2025, could significantly boost demand by offering safer-than-human driving capabilities, potentially transforming the company into a leader in autonomous transportation.

Production and Pricing Adjustments: Tesla is considering increasing Model Y production and prices in response to demand, balancing profitability with market expansion.

Tesla’s Model Y L and the Self-Driving Revolution: Why Autonomy Could Redefine Transportation

Elon Musk’s bold vision for Tesla’s autonomous future raises questions about the Model Y L’s U.S. launch and the transformative potential of Version 14 self-driving technology.

Tesla’s latest moves in the electric vehicle and autonomous driving space are sparking intense discussion among tech enthusiasts. The introduction of the Model Y L in China and advancements in Tesla’s self-driving technology, particularly Version 14, signal a potential shift in how we think about transportation. With Elon Musk hinting that the Model Y L may not come to the U.S. due to the state of autonomy, and posts on X buzzing about the next generation of self-driving software, there’s a lot to unpack. Here’s why these developments could reshape the automotive industry and what they mean for the future of mobility.

Key Takeaways

Model Y L Debuts in China: A stretched version of the bestselling Model Y, featuring a proper third row and captain’s chairs, is set to launch in China at a price equivalent to $47,000, but its U.S. arrival is uncertain due to Tesla’s focus on autonomy.

Autonomy Over New Models: Tesla may prioritize self-driving technology over introducing the Model Y L in the U.S., betting that unsupervised Full Self-Driving (FSD) will drive demand for existing models like the Model Y and Model 3.

Version 14 Breakthrough: The upcoming Version 14 of Tesla’s self-driving software is touted as a significant leap, potentially rivaling the jump from Version 11 to 12, bringing unsupervised autonomy closer to reality.

Robotaxi Momentum: Tesla’s robotaxi service, currently operating with Model Ys in Austin, is a testing ground for unsupervised FSD, with Version 14 expected to enhance reliability and safety.

Disrupting Transportation: If Tesla achieves reliable unsupervised autonomy, it could render traditional vehicles obsolete, transforming cars into productivity hubs and boosting their value as income-generating assets.

Bitcoin: The Digital Fortress Redefining Wealth in a World of Infinite Energy and AI

Unlocking the Power of Scarce Digital Assets Amid Economic Shifts and Technological Leaps

Bitcoin stands out as a resilient store of value in an era where traditional currencies lose purchasing power through constant dilution, while emerging technologies like cheap energy and AI promise to disrupt everything from gold mining to global economies. This newsletter dives into how Bitcoin's fixed supply and built-in security could make it essential for preserving wealth, outperforming stocks, real estate, and even precious metals over long horizons.

Key Takeaways

Bitcoin has consistently outperformed major asset classes like stocks, bonds, and commodities over the past decade, with annualized returns often exceeding 100% in early years and stabilizing around 20-30% recently.

Traditional currencies have lost 65-99% of their purchasing power in the last 30 years across countries from the US to Venezuela due to inflation and debasement, pushing people toward assets that hold value better.

Bitcoin's capped supply at 21 million units creates deflationary pressure on goods priced in it, making items like electronics cheaper over time when viewed through its lens.

Unlike gold, which could be disrupted by asteroid mining or synthetic production via cheap energy, Bitcoin's scarcity is algorithmically enforced and resistant to physical discoveries.

As a protocol, Bitcoin functions first as a cybersecurity tool using massive computational power to deter attacks, potentially securing digital assets in cyberspace beyond just money.

In a future of AI-driven abundance and potential job displacement, governments may print more money to support populations, accelerating the flow into non-debasable assets like Bitcoin.

Corporations are increasingly adopting Bitcoin as a treasury reserve, with holdings now rivaling major tech firms, offering a hedge against currency dilution and a path to long-term capital growth.

Tesla's Robot Revolution: Unlocking Trillion-Dollar Potential in Humanoids and Beyond

Why Tesla's bets on AI-driven robots could redefine global industries—and how investors are missing the bigger picture.

Tesla stands at the forefront of transformative technologies, from humanoid robots poised to reshape labor markets to autonomous ride-sharing networks that could dominate urban mobility. These innovations aren't just incremental improvements; they're gateways to massive economic shifts, drawing on lessons from past disruptors like Nvidia and Amazon. For tech enthusiasts, understanding the underlying models and market dynamics reveals opportunities that traditional finance often overlooks.

Key Takeaways

Humanoid robots represent Tesla's most explosive growth driver, with potential unit economics suggesting profits per bot that could scale into trillions as production ramps up.

Robotaxis follow closely, offering a high-margin service model that leverages autonomous tech to disrupt transportation on a global scale.

Wall Street's short-term horizon—typically 12-18 months—blinds it to long-term disruptors, creating arbitrage for patient retail investors who model future scenarios.

Successful investments hinge on visionary leaders who tackle unsexy, high-barrier problems, building unassailable moats through persistence and innovation.

Retail investors outperform pros in innovative sectors by deeply researching theses, maintaining emotional discipline, and committing to multi-year horizons.

Disruption thrives on first-principles thinking: prioritizing mission-critical features like superior performance over perfection in non-essentials.

Historical examples show that enduring companies emerge from years of "wilderness" development, emerging with unbeatable advantages once they cross key thresholds.